U.S. Stock Market Inches To Record Before Legal Holiday

The U.S. stock market eked out another record close on Wednesday ahead of the Thanksgiving legal holiday as investors assessed the latest reports on the economy and some corporate earnings.

The U.S. stock market eked out another record close on Wednesday ahead of the Thanksgiving legal holiday as investors assessed the latest reports on the economy and some corporate earnings.

Orders for long-lasting manufactured goods rose in October, but a key category that tracks business investment plans declined sharply for a second straight month. Another report showed U.S. consumers spent modestly more in October, a slight improvement after no gain at all in the previous month.

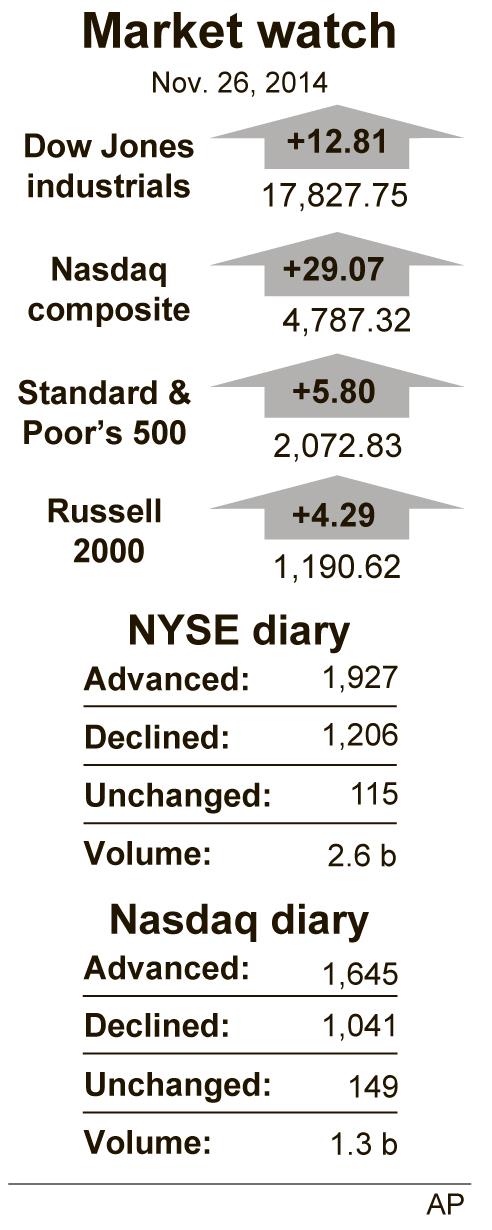

The Standard & Poor’s 500 index rose 5.80 points, or 0.3 percent, to 2,072.83. The index has now closed at an all-time high on 47 occasions this year.

The Dow Jones industrial average rose 12.81 points, or 0.1 percent, to 17,827.75. The Nasdaq composite climbed 29.07 points, or 0.6 percent, to 4,787.32.

Semiconductor stocks were among the gainers on Wednesday after Analog Devices reported income and revenue that exceeded Wall Street’s forecasts. The company said it expects revenue growth of 21 percent in its first fiscal quarter. The stock jumped $2.85, or 5.5 percent, to $54.56, leading gains for semiconductor stocks in the S&P 500, which rose 2.3 percent.

Stocks have rebounded strongly from a slump that lasted from mid-September to mid-October. The S&P 500 has surged 11.3 percent since then. The gains have slowed this week, however, ahead of Thanksgiving.

“This seems to be a classic holiday plateau,” said Kristina Hooper, head of US Capital Markets Research & Strategy for Allianz Global Investors. “Probably, we are not going to get any focus until we come back on Monday.”

The U.S. stock market will be closed on Thursday for Thanksgiving. It will also close early, at 1:00 p.m. Eastern time, on Friday.

Among individual stocks, Deere was among the losers.

The company’s fourth-quarter results were stronger than Wall Street expected, but the company said its sales of farm equipment and its income will keep falling in the company’s new fiscal year. Deere’s stock slid 80 cents, or 0.9 percent, to $86.99.

Energy stocks were once again the biggest loser of the 10 industry groups represented in the S&P 500 index as the price of oil dipped again.

The price of oil slid to another four-year low in light trading ahead of an OPEC meeting Thursday in Vienna that is not expected to result in a cut to global production.

Benchmark U.S. crude fell 40 cents to close at $73.69 a barrel on the New York Mercantile Exchange. Brent crude, a benchmark for international oils used by many U.S. refineries, fell 58 cents to close at $77.75 a barrel on the ICE Futures exchange in London.

Energy stocks slumped 1.1 percent, taking their loss for the year to 5.6 percent. The sector is the only group in the S&P 500 to be down for the year.

In metals trading, futures closed little changed from the day before. Gold fell 50 cents to $1,196.60 an ounce, silver edged down half a cent to $16.55 an ounce and copper was flat at $2.96 a pound.

In bond trading, U.S. Treasury prices rose slightly. The yield on the benchmark 10-year note fell to 2.24 percent from 2.26 on Tuesday.

The dollar edged down to 117.65 yen from 117.85 yen late Tuesday. The euro rose to $1.2507 from $1.2477 late Tuesday.

This article appeared in print on page 10 of edition of Hamodia.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.