U.S. Stocks End a Down Week on an Up Note

U.S. stocks ended a down week on a high note Friday, snapping a five-day losing streak on the strength of energy and financial companies.

U.S. stocks ended a down week on a high note Friday, snapping a five-day losing streak on the strength of energy and financial companies.

A sharp rebound in oil prices and an encouraging report on retail sales helped lift the stock market to its first gain since late last week.

Despite the rally, the major U.S. stocks indexes ended the week down about 1 percent and they remain down more than 8 percent for the year.

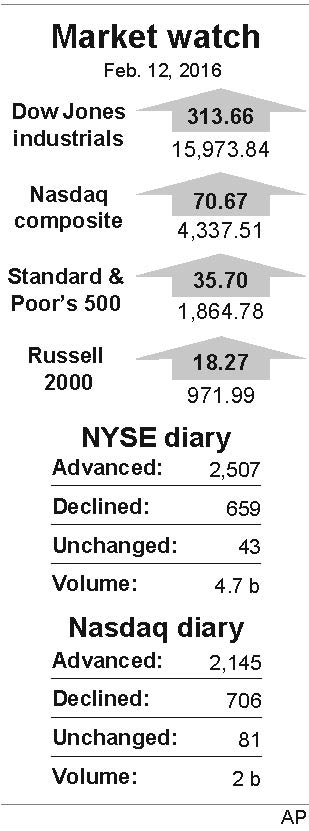

The& Dow& Jones industrial average rose 313.66 points, or 2 percent, to 15,973.84. The Standard & Poor’s 500 gained 35.70 points, or 2 percent, to 1,864.78. The Nasdaq composite added 70.67 points, or 1.7 percent, to 4,337.51.

A surge in oil prices helped put investors in a buying mood early on. A day after sinking to its lowest level since May 2003, benchmark U.S. crude climbed $3.23, or 12.3 percent, to close at $29.44 a barrel in New York. Brent crude, a benchmark for international oils, gained $3.30, or 11 percent, to $33.36 a barrel in London.

The oil rebound sent the S&P 500’s energy companies 2.6 percent higher. Marathon Oil was the best performer in the sector, rising 48 cents, or 6.8 percent, to $7.49.

Financial shares led the market’s advance. The sector is the worst performing part of the market this year.

JP Morgan Chase climbed $4.42, or 8.3 percent, to $57.49, while Citigroup added $2.56, or 7.3 percent, to $37.54. Bank of America rose 79 cents, or 7.1 percent, to $11.95. Meanwhile, Deutsche Bank AG surged 12.1 percent after the bank offered to buy back more than $5 billion in bonds in a display of financial strength. The stock gained $1.87 to $17.38.

Traders also welcomed a report from the Commerce Department indicating a modest gain in retail sales last month. The data, which came in ahead of expectations, suggested that consumers kept shopping despite sharp drops in stock prices.

Encouraging quarterly results from some companies also helped lift the market.

In Europe, Germany’s DAX was up 2.5 percent, while France’s CAC 40 was up 2.5 percent. Britain’s FTSE 100 rose 3.1 percent.

In Asia, Japan’s main stock index fell sharply, leading other Asian markets lower. Tokyo’s Nikkei 225 plunged 4.8 percent after earlier sinking as much as 5.3 percent. Hong Kong’s Hang Seng fell 1.2 percent. South Korea’s Kospi gave up 1.4 percent and Australia’s S&P/ASX 200 fell 1.2 percent. Shares in New Zealand and Southeast Asia also fell. Markets in China and Taiwan were closed all week for the Chinese Lunar New Year and will reopen on Monday.

A day after surging 4.5 percent, gold fell $8.40, or 0.7 percent, to $1,239.40 an ounce. Silver was flat at $15.79 an ounce. Copper, an industrial metal that will often rise and fall along with investor’s optimism about the global economy, rose 2 cents, or 1.1 percent, to $2.03 a pound.

In other energy trading in New York, wholesale gasoline jumped 10 cents, or 10.8 percent, to close at $1.04 a gallon, while home heating oil climbed 9 cents, or 9.2 percent, to close at $1.07 a gallon. Natural gas fell 3 cents, or 1.4 percent, to $1.97 per 1,000 cubic feet.

Bond prices fell. The yield on the 10-year Treasury rose to 1.74 percent from 1.66 percent late Thursday.

In currency markets, the dollar rose to 113.26 yen from 112.27, while the euro fell to $1.1255 from $1.1330.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.