Stocks Slide as Oil Tumbles

U.S. stocks slumped Wednesday as the price of oil suffered its worst one-day drop since September, and the Standard & Poor’s 500 index fell to its lowest level in almost two years.

U.S. stocks slumped Wednesday as the price of oil suffered its worst one-day drop since September, and the Standard & Poor’s 500 index fell to its lowest level in almost two years.

Investors are worried that low oil prices mean there’s not that much demand for fuel. That would be a sign that growth in the global economy is slowing down. Stocks in the U.S. started sharply lower following widespread selling overseas, and looked like they were headed for huge losses. At one point the Dow Jones industrial average fell as much as 565 points.

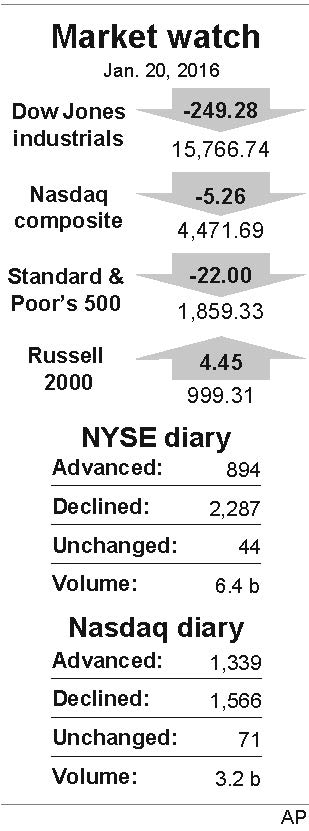

After a late recovery, the Dow closed down 249.28 points, or 1.6 percent, to 15,766.74. The S&P 500 index fell 22 points, or 1.2 percent, to 1,859.33. That is its lowest closing price since April 2014.

The Nasdaq composite, which briefly turned positive in the afternoon, lost 5.26 points, or 0.1 percent, to 4,471.69. The Dow is the lowest it’s been since August, and the Nasdaq is at its lowest since October 2014.

U.S. crude dropped $1.91, or 6.7 percent, to $26.55 a barrel in New York. That was the biggest one-day plunge for U.S. oil since Sept. 1. U.S. crude is down 28 percent in 2016 and is trading at its lowest level since May 2003.

Brent crude, a benchmark for international oils, fell 88 cents, or 3.1 percent, to $27.88 a barrel in London.

The falling price of oil is bad news for companies that drill for oil and sell it, and those companies have slashed jobs and cut back on work to reduce their costs. Banks have lent billions of dollars to energy companies to fund their work, and investors are worried the banks won’t get their money back. It’s good news, however, for car owners and for companies that use a lot of fuel.

Energy stocks were pelted. Devon Energy lost $1.89, or 8 percent, to $21.49 and Exxon Mobil sank $3.22, or 4.2 percent, to $73.18. Financial stocks were also hit because banks could lose billions on loans to oil and gas companies. Bank of America lost 55 cents, or 3.9 percent, to $13.69.

Gold and U.S. government bonds, traditional safe havens, rose in value as investors shifted money out of stocks.

Overseas markets also fell. Japan’s Nikkei index entered a bear market, down 20 percent from its peak in June, and European benchmarks lost between 3 and 4 percent.

Commercial tech giant IBM said its revenue fell for the 15th consecutive quarter. Sales fell about $170 million short of Wall Street forecasts. The stock shed $6.25, or 4.9 percent, to $121.86, for the biggest loss in the Dow average.

Health care stocks rose, led by biotech drugmakers. Celgene added $4.50, or 4.4 percent, to $107.49 and Amgen picked up $3.72, or 2.5 percent, to $155.02.

U.S. government bond prices rose as traders shifted money into lower-risk investments. The yield on the 10-year Treasury note dropped to 1.99 percent, its lowest level since October, from 2.06 percent a day earlier. That yield, which is a benchmark for setting interest rates on home mortgages and other kinds of loans, has fallen sharply since the beginning of the year. At the end of 2015 it stood at 2.30 percent.

The price of gold rose $17.10, or 1.6 percent, to $1,106.20. While gold is far below its prices from the financial crisis, it’s up 4 percent in 2016. The price of silver added 3.9 cents to $14.16 an ounce, and is up almost 3 percent for the year. Copper slipped 1.8 cents to $1.96 a pound and is down 8 percent for the year.

Japan’s Nikkei fell 3.7 percent and is down more than 20 percent from its June peak.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.