Materials, Financials Help Lift S&P 500, Nasdaq to New Highs

U.S. stocks posted solid gains Tuesday, propelling the Standard & Poor’s 500 index and Nasdaq composite to all-time highs.

Mining and other materials sector companies rose more than the rest of the market. The sector could benefit from initiatives by the White House to streamline the permitting process for manufacturing and clear the way for pipeline construction.

Financial stocks also rose sharply. Energy companies climbed as crude oil prices closed higher. The rally also swept up stocks in U.S. homebuilders.

Health care, phone companies and other high-dividend stocks were among the biggest laggards as bond yields rose.

While several big companies reported quarterly earnings, investors focused on the latest batch of executive actions from President Donald Trump.

“The importance of this earnings season has been dimmed only because we all realize there’s going to be some changes in policy,” said J.J. Kinahan, TD Ameritrade’s chief strategist. “Now you’re trading on the edicts, or whatever they may be, that are coming out of the White House.”

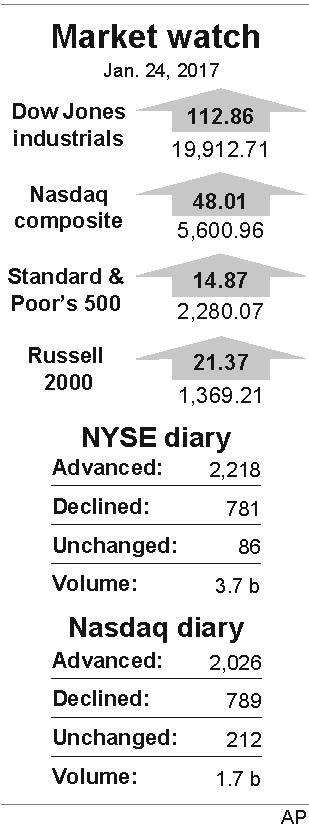

The Dow Jones industrial average climbed 112.86 points, or 0.6 percent, to 19,912.71. The S&P 500 index gained 14.87 points, or 0.7 percent, to 2,280.07. That’s the highest close for the index since Jan. 6.

The Nasdaq added 48.01 points, or 0.9 percent, to 5,600.96. That’s the highest close for the tech-heavy index since Jan. 13.

Small-company stocks outpaced the rest of the market. The Russell 2000 jumped 21.37 points, or 1.6 percent, to 1,369.21.

Trading got off to a sluggish start, with the major stock indexes hovering just above their prior-day levels. Investors bid up shares in several companies that reported better-than-expected earnings, including Kimberly-Clark, which makes Kleenex and other paper products. The company rose $4.81, or 4.1 percent, to $121.79.

Homebuilder D.R. Horton also rose after reporting strong financial results, climbing $1.90, or 6.6 percent to $30.64. DuPont jumped $3.27, or 4.5 percent, to $76.05 after reporting earnings that easily beat analysts’ estimates.

But the action in Washington also held the market’s interest.

Trump hosted a breakfast meeting with the heads of General Motors, Ford Motor Co. and Fiat Chrysler Automobiles. Prior to the meeting, Trump tweeted that he wants “new plants to be built here for cars sold here.” He has warned of a “substantial border tax” on companies that move manufacturing out of the country and promised tax advantages to those that produce domestically.

“They used to call some of this jawboning,” said David Winters, CEO of Wintergreen Advisers. “So, far President Trump has been encouraging companies to do what’s in his vision of a successful America. There’s a lot of enthusiasm, but it’s really going to be what happens in the next couple of months in terms of legislation so there’s clarity.”

Automakers expressed optimism after the meeting. And shares in their companies rose.

GM gained 35 cents, or 1 percent, to $37, while Ford added 30 cents, or 2.4 percent, to $12.61. Fiat Chrysler rose 60 cents, or 5.8 percent, to $10.88.

Trump also signed executive actions to advance construction of the Keystone XL and Dakota Access oil pipelines. President Barack Obama killed the proposed Keystone XL pipeline in late 2015, which would run from Canada to U.S. refineries in the Gulf Coast, saying it would hurt American efforts to reach a global climate change deal.

The Army decided last year to explore alternate routes for the Dakota pipeline after the Standing Rock Sioux tribe and its supporters said the pipeline threatened drinking water and Native American cultural sites.

Mining company Freeport-McMoRan vaulted $1.30, or 8.3 percent, to $17.02, the biggest gainer in the S&P 500 index.

Some companies’ financial results put traders in a selling mood.

Verizon slumped 4.4 percent after the phone and communications company served up earnings for the last three months of 2016 that fell short of what analysts were expecting. The company, whose deal to buy Yahoo’s internet operations may be in jeopardy, also said that its roster of retail postpaid subscribers fell sharply. The stock fell the most among companies in the S&P 500, sliding $2.29 to $50.12.

Major market indexes in Europe were mixed.

Germany’s DAX rose 0.4 percent, while France’s CAC 40 added 0.2 percent. Britain’s FTSE 100 was flat after the Supreme Court said parliament would have a right to vote on whether Britain formally exits the European Union. The ruling doesn’t mean Britain will remain in the EU, but it could delay the process.

In Asia, Japan’s benchmark Nikkei 225 slipped 0.6 percent, while Australia’s S&P/ASX 200 added 0.7 percent to 5,650.10. South Korea’s Kospi slipped 0.01 percent. Hong Kong’s Hang Seng gained 0.2 percent.

Benchmark U.S. crude rose 43 cents, or 0.8 percent, to close at $53.18 a barrel in New York. Brent crude, used to price international oils, gained 21 cents, or 0.4 percent, at $55.44 a barrel in London.

In other energy trading, wholesale gasoline rose a penny to $1.58 a gallon, while heating oil added 2 cents to $1.64 a gallon. Natural gas futures rose 4 cents, or 1.1 percent, to $3.28 per 1,000 cubic feet.

Bond prices fell. The 10-year Treasury yield rose to 2.46 percent from 2.40 percent late Monday.

In currency markets, the dollar rose to 113.89 yen from 113 yen the previous day. The euro fell to $1.0723 from $1.0746.

Among metals, the price of gold slid $4.80, or 0.4 percent, to $1,210.80 an ounce. Silver was little changed at $17.19 an ounce. Copper rose 6 cents, or 2.3 percent, to $2.71 a pound.

This article appeared in print on page 34 of edition of Hamodia.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.