U.S. Stocks Drop as Investors Assess Corporate Earnings

Stocks logged their biggest drop in two weeks on Thursday as investors assessed some disappointing earnings news.

Stocks logged their biggest drop in two weeks on Thursday as investors assessed some disappointing earnings news.

Harman International, which makes audio systems for cars, and Yelp, an online listings company, were among the companies that fell sharply after posting weak earnings.

The stock market has sagged this week after climbing to record levels on Friday.

While many investors remain optimistic that growth will resume later in the year that belief isn’t yet being backed up stronger economic data or good corporate earnings reports. A surge in the dollar in the first three months of the year is hurting company earnings for those that sell overseas, and a plunge in oil prices that lasted into January is hurting the energy sector.

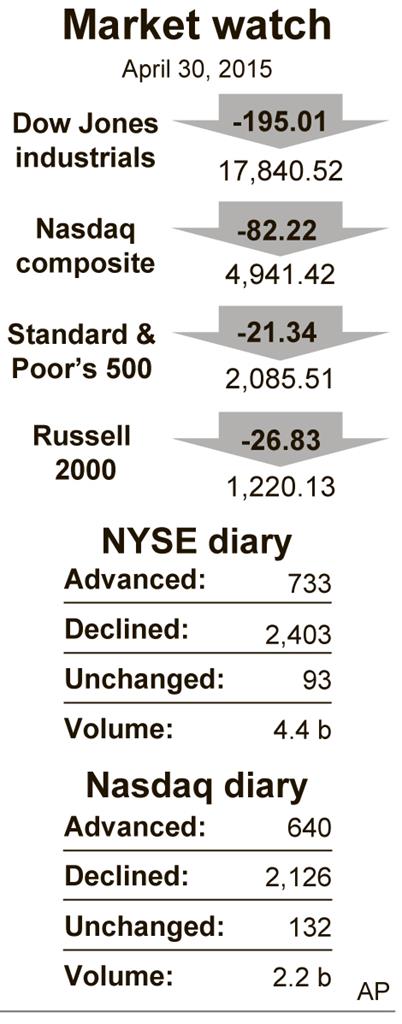

The Standard & Poor’s 500 index dropped 21.34 points, or 1 percent, 2,085.51. That was the biggest drop since April 17. The Dow Jones industrial average slipped 195.01 points, or 1.1 percent, to 17,840.52. The Nasdaq composite declined 82.22 points, or 1.6 percent, to 4,941.42.

Overall corporate earnings have come in better than analysts were expecting, but they are still much weaker than they were at the end of last year.

Gains for stocks have slowed this year, as the market has entered the seventh year of a bull run. After Thursday’s losses, the S&P 500 index was up just 1.3 percent for the year and the Dow just 0.1 percent.

The market is struggling to push higher as stock valuations have climbed. The price-earnings ratio, a measure of how much investors are willing to pay for every $1 of earnings, is now just above 17. Three years ago it was 12.5.

Yelp was among the biggest losers on Thursday. The stock plunged $11.89, or 23 percent, to $38.39 after it reported a loss of $1.3 million in its first quarter and gave a lower-than-expected revenue outlook late Wednesday.

Harman International also dropped after reporting earnings that fell short of analysts’ estimates and lowered its own forecast for revenue and earnings. The company blamed the impact of the appreciating dollar and weaker growth. Its stock fell $9.82, or 7 percent, to $130.38.

The bond market steadied after a sell-off on Wednesday. The yield on the 10-year government Treasury note held at 2.04 percent. The yield on the note has been moving higher after dropping as low as 1.65 percent in January.

Oil rose nearly 2 percent Thursday and finished April with a gain of more than 20 percent. U.S. oil gained $1.05, or 1.8 percent, to $59.63 a barrel. Brent crude rose 94 cents to $66.78 a barrel. Analysts say recent reports showing fewer rigs drilling for oil in the U.S. and supplies leveling off are supporting higher prices.

In metals trading, gold dropped $27.60, or 3.3 percent, to $1,182.40 an ounce. Silver fell 54.6 cents, or 3.3 percent, to $16.12 an ounce. The price of copper rose 9.2 cents, or 3.3 percent, to $2.89 per pound.

The euro rose to $1.1240 from $1.1114 the day before. The dollar rose to 119.35 yen from 119.01 yen.

In other energy futures trading on the New York Mercantile Exchange:

- Wholesale gasoline gained 3.2 cents to $2.05 a gallon.

- Heating oil rose 2.8 cents to $1.976 a gallon.

- Natural gas rose 14.5 cents to $2.751 per 1,000 cubic feet.

This article appeared in print on page 8 of edition of Hamodia.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.