Wall Street Ends Manic Week With a Gain, Led by Tech Stocks

NEW YORK (AP) – In a manic week full of previously unthinkable market moves, Wall Street ended Friday with one reminiscent of what things were like before the coronavirus outbreak upended everything.

The S&P 500 glided to a gain of 1.4%, with Apple, Microsoft and other technology stocks leading the way, as they did so many times before the economy shut down in hopes of slowing the spread of the outbreak. The bond market was quiet, while crude prices climbed again.

The gains offered a soothing coda for a wild week, which began with Monday’s astonishing plummet for oil and carried through Thursday’s sudden disappearance of a morning stock rally, as markets pinballed from fear to hope and back again.

The S&P 500 still lost 1.3% for the week as worries about the economic damage dealt by the coronavirus outbreak outweighed hopes that businesses could soon reopen. That snapped the first two-week winning streak for the S&P 500 since it began selling off in February.

Reports piled higher through the week showing the pandemic is bludgeoning the economy even more than economists had feared. Roughly one in six U.S. workers has filed for unemployment benefits over the last five weeks.

The damage is so severe that a heavily divided Congress has reached bipartisan agreement on massive support for the economy. President Donald Trump signed a bill Friday to provide nearly $500 billion more, including loans for small businesses and aid for hospitals.

Next week will be one of the busiest of this earnings season, with more than 150 companies in the S&P 500 reporting how much they made during the first three months of the year. Many companies have been pulling their profit forecasts entirely for 2020 given all the uncertainty, and Wall Street is slashing its own estimates.

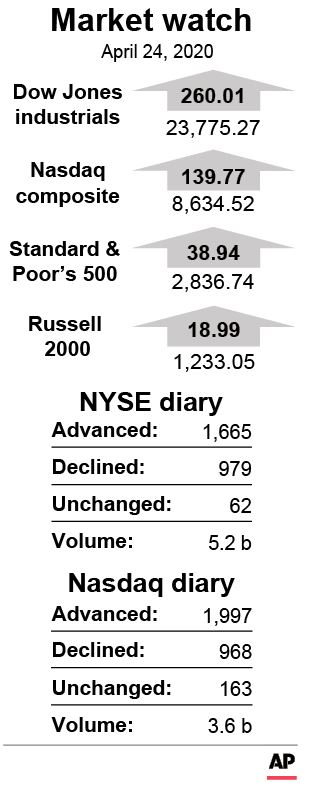

The S&P 500 added 38.94 points to 2,836.74. The Dow Jones Industrial Average rose 260.01, or 1.1%, to 23,775.25, and the Nasdaq composite added 139.77, or 1.7%, to 8,634.52.

Gains for big tech stocks led the way. Tech makes up an outsized portion of the S&P 500 following years of market dominance. And because changes in market value dictate the index’s moves, the performance of the biggest stocks can have a disproportionate effect.

Many professional investors have been skeptical of the market’s recent rally. They say there’s still too much uncertainty about how long the recession will last and that attempts to reopen the economy could trigger more waves of infections if they’re premature.

In a demonstration of how hungry the market is for a vaccine or treatment for COVID-19, the S&P 500 erased a rally of more than 1% in a span of seconds on Thursday following a discouraging report about a potential drug treatment.

The S&P 500 is down 16.2% from its record in February, though it’s more than halved its loss since late March.

The price of a barrel of U.S. oil to be delivered in June rose 2.7% to settle at $16.94. It had sunk as low as $6.50 earlier this week on worries that storage tanks are close to topping out amid a collapse in demand. Worries about extra oil with nowhere to go sent prices in one corner of the U.S. oil market below zero on Monday.

Brent crude, the international standard, rose 0.5% to $21.44 per barrel.

The yield on the 10-year Treasury note slipped to 0.60% from 0.61% late Thursday. Yields tend to fall when investors are downgrading their expectations for the economy and inflation.

European and Asian stock markets fell.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.