Sinking Energy Stocks Pull S&P 500 to Fourth Straight Loss

U.S. stocks took another small step backward on Wednesday after a plunge in the price of oil dragged down shares of energy producers. The losses overshadowed gains for technology companies and other areas of the market.

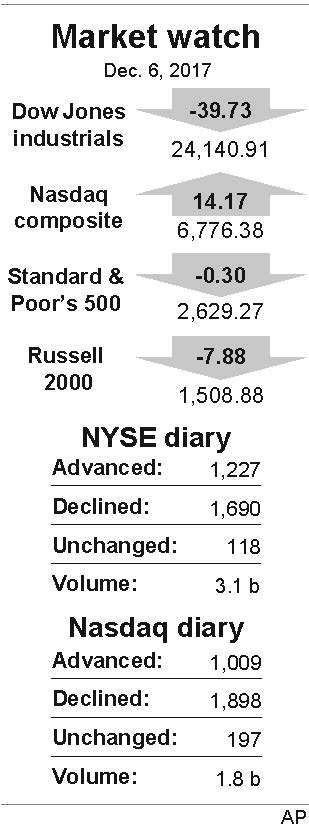

The Standard & Poor’s 500 index dipped by a fraction of a point, down 0.30 to 2,629.27, and it’s down just 0.5 percent so far this week. But even those modest movements could count as notable in a year that’s been unusually calm and easy for investors. It was the fourth straight loss for the index, the first time that has happened since March.

The Dow Jones industrial average fell 39.73 points, or 0.2 percent, to 24,140.91, the Nasdaq composite rose 14.16, or 0.2 percent, to 6,776.38 and the Russell 2000 index of small-cap stocks lost 7.88, or 0.5 percent, to 1,508.88.

Stocks have been mostly drifting lower this week following a strong run for markets this year. The ups and downs have come as the Senate and House of Representatives try to iron out differences in their proposals to overhaul the tax system, and investors shift their portfolios toward companies that stand to benefit most from lower rates.

The market’s biggest movers were energy stocks, which sank with the price of oil. Benchmark U.S. crude fell $1.66 to settle at $55.96 per barrel. Brent crude, the international standard, lost $1.64 to $61.22 a barrel.

That led to a 1.3 percent loss for energy stocks in the S&P 500, the sharpest drop among the 11 sectors that make up the index. Oil company Newfield Exploration fell $2.12, or 6.9 percent, to $28.44 for the biggest loss of any stock in the S&P 500.

Companies in the dental industry were also weak, hurt by fears that their industry is the next that Amazon will upend. Patterson Companies lost $1.51, or 4.2 percent, to $34.81, and Henry Schein fell $3.52, or 5 percent, to $67.58.

On the winning side was DaVita, which jumped to the biggest gain in the S&P 500 after UnitedHealth Group said it will buy DaVita’s medical group, which serves patients through nearly 300 medical clinics, for $4.9 billion in cash. DaVita gained $8.27, or 13.6 percent, to $69.20.

Technology stocks also rose, and they recovered some of their losses from earlier in the week.

Treasury yields sank as prices for government bonds rose. The yield on the 10-year Treasury note dropped to 2.33 percent from 2.35 percent late Tuesday.

In markets overseas, Asian stocks slumped. Japan’s Nikkei 225 index lost 2 percent for its worst day since March. The Hang Seng in Hong Kong dropped 2.1 percent, and South Korea’s Kospi lost 1.4 percent.

In Europe, markets trimmed their losses as the day progressed. Germany’s DAX dropped 0.4 percent, and France’s CAC 40 ended little changed. The FTSE 100 in London rose 0.3 percent.

The dollar dipped to 112.28 Japanese yen from 112.62 yen late Monday. The euro fell to $1.1793 from $1.1816, and the British pound slipped to $1.3375 from $1.3442.

In the commodities markets, natural gas rose a cent to $2.92 per 1,000 cubic feet, heating oil fell 5 cents to $1.86 per gallon and wholesale gasoline dropped 6 cents to $1.66 per gallon.

Gold ticked up by $1.20 to $1,266.10 per ounce, and silver fell 11 cents to $15.96 per ounce. Copper recovered a fraction of its sharp loss from the day before and rose 2 cents to $2.96 per pound.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.