Banks and Tech Stocks Send Dow Industrials Closer to 22,000

Banks and technology companies took U.S. stocks higher Tuesday, and less-loved sectors including phone and real estate companies also climbed as companies continued to report strong second-quarter results.

Payment processors also made hefty gains, while Sprint said it gained wireless subscribers and that it’s open to combining with a competitor or a cable company. Royal Caribbean Cruises, Xerox and shopping mall operator Simon Property Group all climbed, while athletic apparel maker Under Armour and industrial companies fell after disappointing results. General Motors and Ford slumped on weak July sales reports.

Some of the largest gains went to companies and industries that have struggled this year, like real estate investment trusts, or which have missed out on the gains entirely, like phone companies. Randy Frederick, vice president of trading and derivatives at the Schwab Center for Financial Research, said the shift is a good sign for the stock market.

The Standard & Poor’s 500 index rose 6.05 points, or 0.2 percent, to 2,476.35. The Dow Jones industrial average climbed 72.80 points, or 0.3 percent, to 21,963.92. The blue chip index closed at a record high for the fifth day in a row. Nasdaq composite added 14.82 points, or 0.2 percent, to 6,362.94. The Russell 2000 index of smaller-company stocks gained 3.19 points, or 0.2 percent, to 1,428.33.

Banks helped lead the way. The top gainers included JPMorgan Chase, which rose $1.23, or 1.3 percent, to $93.03 and Citigroup, which added $1.15, or 1.7 percent, to $69.60.

Intel rose as South Korean regulators signed off on its deal for Mobileye. Mobileye makes software that processes information from cameras and other car sensors to decide where an autonomous car should steer, and Intel agreed to buy it for $15 billion in March. Intel gained 88 cents, or 2.5 percent, to $36.35.

Sprint had its best day this year after it said it’s open to combining with another phone company or a cable company. The fourth-largest U.S. wireless carrier also reported its first quarterly profit in three years as it cut cost and added wireless subscribers. Sprint rose 89 cents, or 11.2 percent, to $8.87.

T-Mobile USA climbed $1.41, or 2.3 percent, to $63.07 and Verizon Communications gained 49 cents, or 1 percent, to $48.89. Phone companies, real estate firms and utility all benefited because bond yields fell, which made the companies more attractive to investors who want income.

Cruise line operator Royal Caribbean beat analysts’ forecasts and raised its estimates for the year. It climbed $3.8, or 3.4 percent, to $116.87 and competitor Carnival advanced 70 cents, or 1 percent, to $67.48.

Oil prices plunged after a six-day rally. U.S. crude shed $1.01, or 2 percent, to $49.16 a barrel in New York. Brent crude, the international standard, dropped 94 cents, or 1.8 percent, to $51.78 a barrel in London.

Wholesale gasoline lost 2 cents to $1.66 a gallon. Heating oil fell 3 cents to $1.64 a gallon. Natural gas rose 3 cents to $2.82 per 1,000 cubic feet.

Bond prices climbed. The yield on the 10-year Treasury note dipped to 2.25 percent from 2.30 percent.

Gold added $6 to $1,279.40 an ounce. Silver lost 2 cents to $16.76 an ounce. Copper dipped 1 cent to $2.88 a pound.

The dollar rose to 110.30 yen from 110.24 yen. The euro slid to $1.1801 from $1.1831.

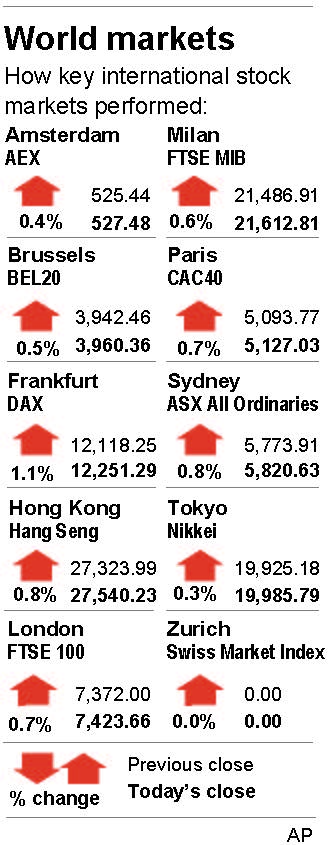

The DAX in Germany DAX rose 1.1 percent. Britain’s FTSE 100 and the French CAC 40 both rose 0.7 percent. Japan’s benchmark Nikkei 225 index added 0.3 percent while South Korea’s Kospi climbed 0.8 percent. In Hong Kong, the Hang Seng gained 0.8 percent.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.