Stocks Wind Up Mixed as Retailers Rise, Health Care Dips

U.S. stocks hardly budged Monday as smaller firms and retailers rose while health care companies and banks declined. Chemical and mining companies rose as the dollar weakened.

Precious metals rose as the dollar, already at its lowest levels in almost a year, weakened a bit further. Bond yields slipped, sending banks lower and high-dividend stocks like utilities and household goods companies higher.

With indexes at or near record highs and another round of corporate earnings reports just beginning, investors didn’t make many big moves and stocks wobbled between small gains and losses all day.

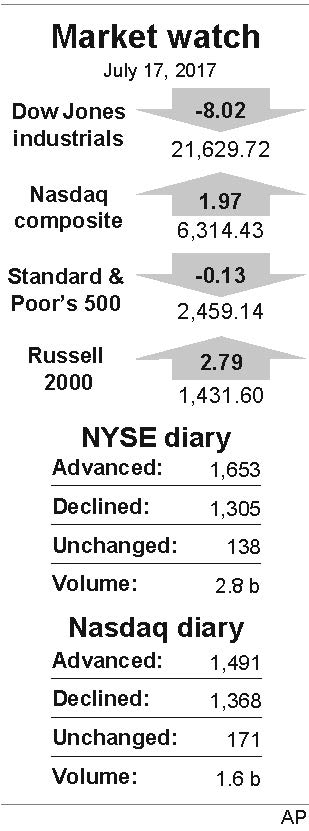

The Standard & Poor’s 500 index lost 0.13 points to 2,459.14. The Dow Jones industrial average shed 8.02 points to 21,629.72. The Nasdaq composite gained 1.97 points to 6,314.43. The Russell 2000 index of smaller-company stocks rose 2.79 points, or 0.2 percent, to 1,431.60.

The S&P 500, Dow and Russell 2000 all closed at record highs Friday. The Nasdaq has rallied almost 4 percent in the last seven days, and it’s recovered almost all of the losses it sustained when technology companies went into a slump in early June.

The dollar has been declining this year as investors have concluded the federal government isn’t close to any kind of infrastructure spending package, which would strengthen the U.S. economy. Meanwhile economies in Europe are doing better and interest rates there are rising, which makes European currencies stronger.

The dollar rose to 112.66 yen from 112.56 yen. The euro rose to $1.1480 from $1.1467. The ICE U.S. Dollar Index is at its lowest level since early September.

Gold rose $6.20 to $1,233.70 an ounce. Silver gained 17 cents, or 1 percent, to $16.10 an ounce. Copper rose 3 cents, or 1.2 percent, to $2.72 a pound.

Bond prices rose. The yield on the 10-year Treasury note fell to 2.31 percent from 2.33 percent.

FedEx said shipping volumes for its TNT Express business are down and customers are still experiencing delays after the business was hit by a cyberattack in late June. The company’s stock fell $3.58, or 1.6 percent, to $215.48.

Meal kit company Blue Apron tumbled after The Sunday Times reported that Amazon is getting ready to launch its own meal-prep business. The British newspaper reported that Amazon registered a trademark for a food kit business.

Diamond producer Dominion Diamond agreed to be bought by Washington Cos. for $14.25 a share, or about $1.2 billion. The company’s stock gained 59 cents, or 4.4 percent, to $14.07.

Church & Dwight, the consumer products maker behind Arm & Hammer baking soda and other brands, said it will buy showerhead and water-powered toothbrush maker Water Pik for $1 billion.

Benchmark U.S. crude lost 52 cents, or 1.1 percent, to $46.02 a barrel in New York. Brent crude, used to price international oils, fell 49 cents, or 1 percent, to $48.42 a barrel in London.

Wholesale gasoline stayed at $1.56 a gallon. Heating oil lost 2 cents to $1.50 a gallon. Natural gas added 4 cents to $3.02 per 1,000 cubic feet.

London’s FTSE 100 index rose 0.3 percent while the French CAC 40 shed 0.1 percent. Germany’s DAX finished 0.4 percent lower. The Hang Seng in Hong Kong gained 0.3 percent and the Kospi of South Korea added 0.4 percent.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.