Modest Gains, Led by Banks, Push U.S. Stock Indexes Higher

Financial companies led U.S. stock indexes higher Thursday, nudging the Nasdaq composite index to a record high.

The latest gains came as the stock market continued to trade mostly in a narrow range in the absence of major new economic data and ahead of next week’s meeting of Federal Reserve policymakers.

Speculation that the Fed will raise interest rates helped boost financial stocks for the second day in a row. Higher interest rates allow banks and credit card issuers to charge more for loans, which boosts profits.

Utilities and consumer goods companies were among the biggest decliners. Energy stocks also fell as crude oil prices declined.

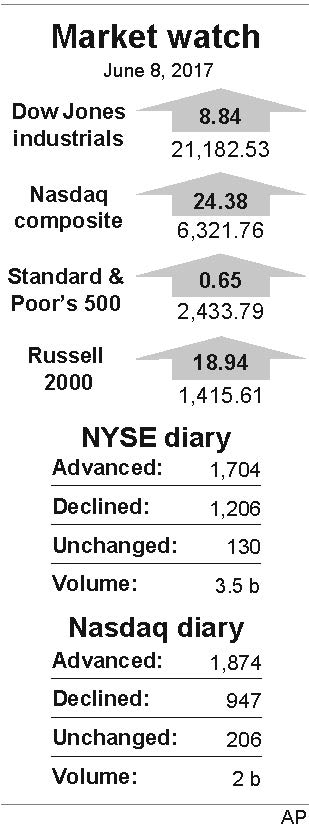

The Standard & Poor’s 500 index gained 0.65 points, or 0.03 percent, to 2,433.79. The Dow Jones industrial average rose 8.84 points, or 0.04 percent, to 21,182.53. Both indexes remain slightly below their record highs set last Friday.

The Nasdaq added 24.38 points, or 0.4 percent, to 6,321.76. Small-company stocks fared better than the rest of the market. The Russell 2000 index climbed 18.94 points, or 1.4 percent, to 1,415.61.

Bond prices fell. The 10-year Treasury yield rose to 2.19 percent from 2.18 percent late Wednesday.

Stocks wavered between small gains and losses through much of the day as investors tuned in to watch former FBI Director James Comey testify before Congress as part of the investigation into Russian meddling into the U.S. presidential election.

Stock indexes barely budged during the hearing, the public portion of which wrapped around midday.

The Republican-led House took steps Thursday to advance the president’s pledge to ease regulations on businesses by taking a vote on legislation that would undo the stricter banking rules that took effect after the devastating 2008 financial crisis. That helped lift bank stocks.

Goldman Sachs Group picked up $2.98, or 1.4 percent, to $218.76. JPMorgan Chase added $1.04, or 1.2 percent, to $84.95. Regions Financial gained 44 cents, or 3.2 percent, to $14.03.

Traders also welcomed news that members of the Nordstrom family are considering taking the company private. On Thursday, the stock soared $4.15, or 10.3 percent, to $44.63.

Benchmark U.S. crude wavered for much of the day before sliding 8 cents to settle at $45.64 a barrel in New York. Brent crude, used to price international oils, fell 20 cents to close at $47.86 per barrel in London. Wholesale gasoline held steady at $1.49 per gallon. Heating oil rose 1 cent to $1.42 per gallon. Natural gas added 1 cent to $3.03 per 1,000 cubic feet.

The dollar rose to 109.94 yen from Wednesday’s 109.83 yen. The euro weakened to $1.1222 from $1.1252.

In metals trading, gold fell $13.70, or 1.1 percent, to $1,279.50 per ounce. Silver lost 21 cents, or 1.2 percent, to $17.41 per ounce. Copper gained 6 cents, or 2.3 percent, to $2.61 per pound.

European stock markets were mixed after the European Central Bank kept its stimulus program unchanged. ECB President Mario Draghi said Thursday that risks to the European economic recovery have diminished. Germany’s DAX rose 0.3 percent, while France’s CAC 40 slipped 0.2 percent. Britain’s FTSE 100 fell 0.4 percent as Britain went to the polls in a general election.

In Asia, Japan’s benchmark Nikkei 225 index lost 0.3 percent. South Korea’s Kospi edged up 0.2 percent.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.