Technology Companies and Banks Take Stocks Higher

U.S. stocks rose Monday as big technology companies like Apple continued to rally. Investors bought stocks and sold bonds and gold after Congress agreed to a deal that will keep the government operating for the rest of the fiscal year.

Technology companies have set the pace all year and are up more than twice as much as the rest of the market. Apple and Facebook, which will report their first-quarter results in the next few days, helped lead the way.

Investors were relieved that the threat of a government shutdown appears to have been averted, so they bought riskier stocks and sold government bonds, gold and high-dividend stocks. The VIX, an index that is seen as a measure of the market’s anxiety level, fell to its lowest level since February 2007.

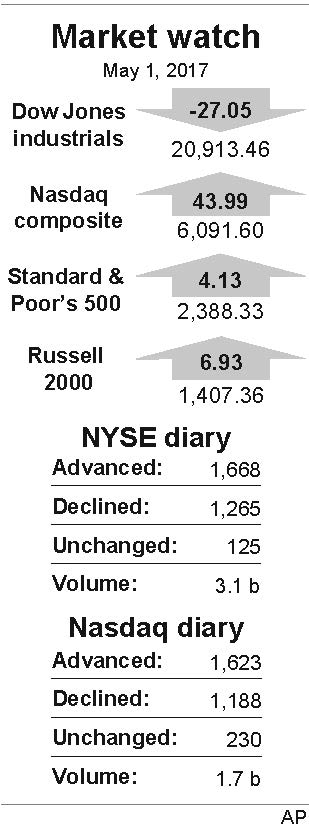

The Standard & Poor’s 500 index picked up 4.13 points, or 0.2 percent, to 2,388.33. The Dow Jones industrial average lost 27.05 points, or 0.1 percent, to 20,913.46 as Boeing and IBM lagged.

Thanks to the gains for technology companies, the Nasdaq composite rose 44 points, or 0.7 percent, to 6,091.60, and set another record high. The Russell 2000 index of small-company stocks gained 6.93 points, or 0.5 percent, to 1,407.36.

Apple climbed $2.95, or 2.1 percent, to $146.60 and Facebook added $2.21, or 1.5 percent, to $152.46. Microsoft, which disclosed its earnings last week, rose 95 cents, or 1.4 percent, to $69.41.

Online retailer Amazon.com stood out among consumer-focused companies as it picked up $23.44, or 2.5 percent, to $948.43.

With investors reassured, they sold bonds. The yield on the 10-year Treasury note rose to 2.32 percent from 2.29 percent. That sent interest rates higher, which allows banks to charge higher interest rates on loans. Capital One Financial advanced $1.19, or 1.5 percent, at $81.57 and Citizens Financial rose 56 cents, or 1.5 percent, to $37.13.

Aerospace companies struggled after aircraft parts distributor Wesco Aircraft Holdings gave a weak second-quarter forecast. The company also said its president and CEO retired, and its stock tumbled $2.20, or 18.1 percent, to $9.95. Boeing fell $2.44, or 1.3 percent, to $182.39 and aircraft and helicopter maker Textron gave up 53 cents, or 1.1 percent, to $46.13.

Industrial companies lagged the rest of the market following a report that output by U.S. factories didn’t grow as much as analysts expected. The Institute for Supply Management said new orders and hiring grew more slowly in April.

Benchmark U.S. crude fell 49 cents, or 1 percent, to $48.84 a barrel in New York. Brent crude, used to price international oils, declined 53 cents, or 1 percent, to $51.52 a barrel in London.

Wholesale gasoline lost 2 cents to $1.53 a gallon. Heating oil fell 2 cents to $1.49 a gallon. Natural gas dropped 6 cents to $3.22 per 1,000 cubic feet.

The price of gold fell $12.80, or 1 percent, to $1,255.50 an ounce. Silver fell 42 cents, or 2.4 percent, to $16.84 an ounce. Copper rose 5 cents, or 2 percent, to $2.66 a pound.

The dollar rose to 111.83 yen from 111.44 yen. The euro advanced to $1.0906 from $1.0895.

Many markets in Asia and Europe were closed for May Day. Japan’s benchmark Nikkei 225 was an exception and it gained 0.6 percent. Stocks in Japan were helped by a weaker yen and strong readings in a manufacturing survey.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.