Drops for Postelection Winners Drag Stocks Lower

U.S. stocks fell Monday as investors grew nervous after President Donald Trump imposed a travel ban on seven Muslim-majority countries. Energy companies, which have surged over the last year, took the biggest losses.

Investors took profits, selling shares of basic materials and industrial companies, which had rallied following the November election. The VIX, a measure of Wall Street volatility, jumped, though it remains relatively low overall. Stocks in Europe lost ground as well.

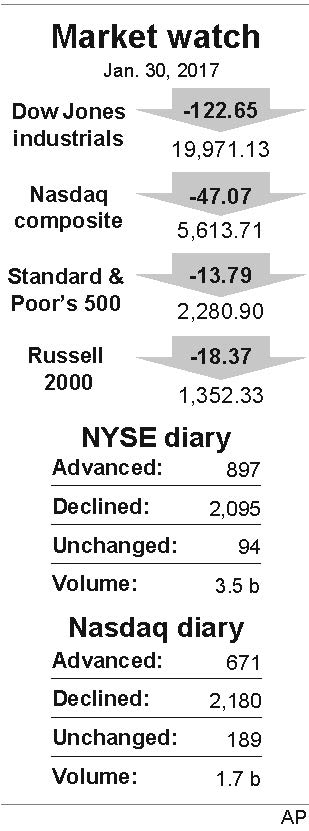

The Dow Jones industrial average fell 122.65 points, or 0.6 percent, to 19,971.13. It dropped as much as 223 points in the morning. The Standard & Poor’s 500 index lost 13.79 points, or 0.6 percent, to 2,280.90.

The Nasdaq composite dropped 47.07 points, or 0.8 percent, to 5,613.71 after it closed at an all-time high Friday. Small-company stocks were hit harder. The Russell 2000 index shed 18.37 points, or 1.3 percent, to 1,352.33.

Airlines skidded after Trump’s executive order led to protests and disruption at airports and concerns about travel. Big-name technology companies sagged on concerns that future administration moves will make it harder for them to hire workers.

American Airlines fell $2.05, or 4.4 percent, to $44.90 and United Continental lost $2.70, or 3.6 percent, to $71.72.

Domestic airlines also struggled, and so did other companies that don’t necessarily have much at stake in disputes over immigration policy or global trade.

Construction and mining company Caterpillar fell $2.20, or 2.2 percent, to $96.79 and construction and technical services company Jacobs Engineering dipped 98 cents, or 1.6 percent, to $59.38.

U.S. crude oil slid 54 cents, or 1 percent, to $52.63 a barrel in New York. Brent crude, the benchmark for international oil prices, fell 29 cents to $55.23 a barrel in London.

Mattress maker Tempur Sealy hit a three-year low after it said retailer Mattress Firm is moving to terminate its supply contracts with the company. Tempur Sealy said Mattress Firm wanted to make big changes to supply agreements and the two sides weren’t able to reach a compromise. It expects the two companies to stop doing business during the first quarter. Tempur Sealy said it made 21 percent of its net sales last year to Mattress Firm. Its stock fell $17.70, or 28 percent, to $45.49.

Fitness tracker maker Fitbit dropped $1.15, or 16 percent, to $6.06 after the company posted weak fourth-quarter sales and said it will eliminate about six percent of its jobs, or about 110 positions.

Bond prices slipped. The yield on the 10-year Treasury note rose to 2.49 percent from 2.48 percent.

The dollar fell to 113.67 yen from 115.09 yen. The euro dipped to $1.0695 from $1.0698.

In other energy trading, natural gas futures fell 13 cents, or 3.8 percent, to $3.23 per 1,000 cubic feet. Wholesale gasoline lost 2 cents to $1.51 a gallon. Heating oil dipped 1 cent to $1.61 a gallon.

The price of gold rose $4.80 to $1,193.20 an ounce. Silver added 2 cents to $17.15 an ounce. Copper lost 3 cents, or 1.3 percent, to $2.66 a pound.

The DAX of Germany fell 1.1 percent and the French CAC-40 also shed 1.1 percent while Britain’s FTSE 100 was 0.9 percent lower. Japan’s Nikkei 225 fell 0.5 percent. Other major indexes in Asia were closed for the Chinese New Year.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.