A Broad Rally Drives Dow, S&P 500 Indexes to Record Highs

The Dow Jones industrial average and Standard & Poor’s 500 indexes soared to their biggest gains since the presidential election on Wednesday and set all-time highs. Investors bought stocks that do well in times of faster economic growth, like technology and industrial companies, but they also snapped up stocks that pay large dividends.

Stocks moved steadily higher throughout the day after a mixed open. Phone and real estate companies made the largest gains, but the rally moved into high gear in the afternoon, as airlines, railroads and trucking companies soared.

Investors took the rally in transportation stocks as a sign of optimism about economic growth. Technology and consumer-focused companies also jumped. Biotech drug companies took steep losses after President-elect Donald Trump said he wants to reduce drug prices.

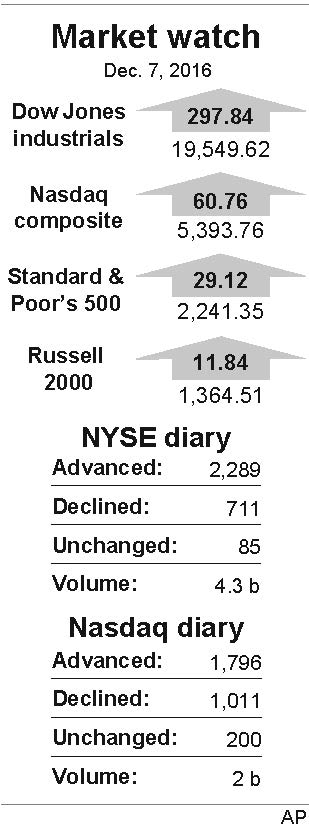

The Dow Jones industrial average jumped 297.84 points, or 1.5 percent, to 19,549.62. The Standard & Poor’s 500 index rose 29.12 points, or 1.3 percent, to 2,241.35. The Nasdaq composite recovered from an early loss to rise 60.76 points, or 1.1 percent, to 5,393.76. That was about five points short of its all-time high.

The Russell 2000 index of small-company stocks also recovered from an early loss and set its own a record as it gained 11.84 points, or 0.9 percent, to 1,364.51.

U.S. government bond prices rose, sending yields lower. The yield on the 10-year Treasury note fell to 2.34 percent from 2.39 percent. Bond yields have risen sharply since the summer but have slipped in the last few days.

The lower bond yields have helped stocks that are seen as bond substitutes, like real estate investment trusts. Their big dividends are attractive to investors who want income, so when bond yields fall, investors often turn to those stocks. Industrial real estate company Prologis rose $1.62, or 3.2 percent, to $52.32 and Verizon picked up $1.02, or 2 percent, to $51.38.

A wide array of companies that stand to benefit from faster economic growth also climbed. Home improvement retailer Lowe’s rose $3.94, or 5.4 percent, to $76.40 and truck maker Paccar jumped $3.20, or 5 percent, to $67.63. U.S. Steel added $1.54, or 4.3 percent, to $37.49.

Benchmark U.S. crude oil lost $1.16, or 2.3 percent, to $49.77 a barrel in New York. Brent crude, the international standard, slid 93 cents, or 1.7 percent, to $53 a barrel in London. Energy companies traded higher Wednesday, although they rose less than the rest of the market.

European stock indexes jumped as investors anticipated that the European Central Bank will extend its bond-buying stimulus program Thursday. The stimulus is designed to boost growth and inflation. European stock indexes climbed. Germany’s DAX gained 2 percent and the FTSE 100 in Britain rose 1.8 percent. The CAC 40 of France picked up 1.4 percent.

The dollar fell to 113.85 yen from 114.05 yen. The euro rose to $1.0759 from $1.0715.

In other energy trading, wholesale gasoline lost 3 cents to $1.51 per gallon. Heating oil slipped 2 cents to $1.62 a gallon. Natural gas fell 3 cents to $3.60 per 1,000 cubic feet.

Gold rose $7.40 to $1,177.50 an ounce. Silver jumped 47 cents to $17.28 an ounce. Copper dipped 4 cents to $2.64 a pound.

Japan’s benchmark Nikkei 225 rose 0.7 percent and the South Korean Kospi inched up 0.1 percent. The Hang Seng in Hong Kong gained 0.5 percent.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.