Stocks Tumble on Worries About the Fed and Economic Growth

U.S. stocks abruptly changed course again Tuesday and took large losses. Investors worried about the possibility of a weaker global economy and tried to anticipate the Federal Reserve’s plans for interest rates. Energy companies fell with the price of oil after a leading industry group said demand for oil is down more than it previously thought.

Stocks sank over the first few hours of trading and never regained their footing. The price of oil fell 3 percent after the International Energy Agency’s remarked they expect weaker growth because of a more pronounced slowdown in the global economy.

Bond yields jumped and phone companies dropped. Apple was one of the few bright spots after T-Mobile said preorders for Apple’s newest iPhones are strong.

After two months of unusual calm, stocks have whipsawed over the last few days. They plunged Friday and recovered half those losses on Monday, only to drop lower Tuesday. Confusion over the Fed’s intentions has been a major factor.

Randy Frederick, vice president of trading and derivatives at Charles Schwab, said investors don’t know what the Fed will do at its meeting next Tuesday and Wednesday. The market may be volatile until then.

“Some of the things they said Friday scared people,” he said. “Monday they tried to calm them down. Now they’re in a quiet period so we don’t know what they’re thinking.”

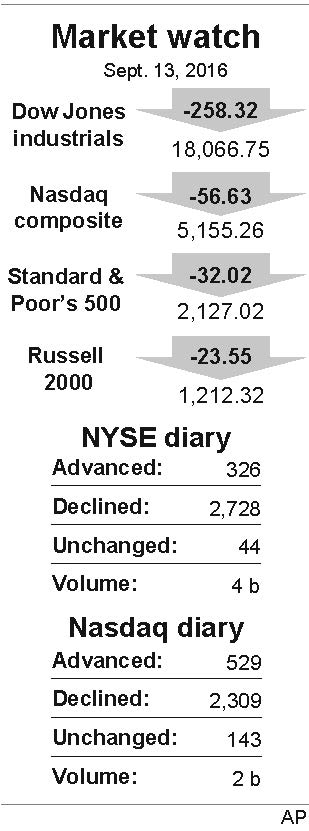

The Dow Jones industrial average gave up 258.32 points, or 1.4 percent, to 18,066.75. The Standard & Poor’s 500 index fell 32.02 points, or 1.5 percent, to 2,127.02. The Nasdaq composite lost 56.63 points, or 1.1 percent, to 5,155.26.

The IEA, which represents 29 oil-producing countries, is predicting slower growth in demand for oil because of a more pronounced economic slowdown during the third quarter of the year, among other factors. The price of oil has plunged over the last two years as an enormous supply glut built up while growth in demand slowed.

Investors have been worried about a possible slowdown in economic growth. Those fears were a big reason stocks tumbled in January and early February.

U.S. crude fell $1.39, or 3 percent, to $44.90 a barrel in New York. Brent crude, the benchmark for international oil prices, slid $1.22, or 2.5 percent, to $47.10 a barrel in London.

Exxon Mobil sank $2.08, or 2.4 percent, to $85.21 and Marathon Oil stumbled $1.13, or 7.3 percent, to $14.34. Anadarko Petroleum agreed to pay $2 billion to buy Freeport-McMoRan’s deepwater assets in the Gulf of Mexico. Anadarko stock dipped 20 cents to $57.59 and Freeport-McMoRan fell 93 cents, or 8.4 percent, to $10.15.

U.S. government bond prices fell. The yield on the 10-year Treasury note rose to 1.73 percent from 1.67 percent. The yield on the 30-year Treasury bond also jumped. Both yields are the highest they’ve been since late June, right before Britain voted to leave the European Union.

Only 20 stocks in the S&P 500 index traded higher. Some of the largest losses went to phone companies.Verizon shed $1.12, or 2.1 percent, to $51.45 and AT&T fell 74 cents, or 1.8 percent, to $39.97.

Among the few gainers was chipmaker Intersil, which agreed to be bought by Renesas of Japan.

In other energy trading, wholesale gasoline lost 1 cent to $1.38 a gallon. Heating oil sank 2 cents to $1.42 a gallon. Natural gas fell 1 cent to $2.91 per 1,000 cubic feet. Gold dipped $1.90 to $1,323.70 an ounce. Silver fell 3 cents to $18.98 an ounce. Copper held steady at $2.10 a pound.

The dollar rose to 102.72 yen from 101.84 yen. The euro fell to $1.1208 from $1.1241.

Germany’s DAX lost 0.4 percent while France’s CAC-40 slipped 1.2 percent. The FTSE 100 index of leading British shares was down 0.5 percent. Asian stocks mostly rallied.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.