Stocks Leap For a 3rd Day, Driven by Gains in Oil and Tech

Stocks climbed Wednesday as investors clung to hope for an international deal to stem a global glut in crude oil with production cutbacks. That sent the price of oil sharply higher, as well as the stocks of major energy companies like Chevron. Tech stocks also rose, led by Microsoft and Facebook.

Stocks climbed Wednesday as investors clung to hope for an international deal to stem a global glut in crude oil with production cutbacks. That sent the price of oil sharply higher, as well as the stocks of major energy companies like Chevron. Tech stocks also rose, led by Microsoft and Facebook.

The gains capped a three-day rally, the longest so far in 2016, that has wiped out about half of the market’s losses since the beginning of the year. The Standard & Poor’s 500 index hit its lowest point of the year last Thursday, and has risen about 5 percent since then.

Priceline, Fossil, and Garmin rose after reporting robust earnings.

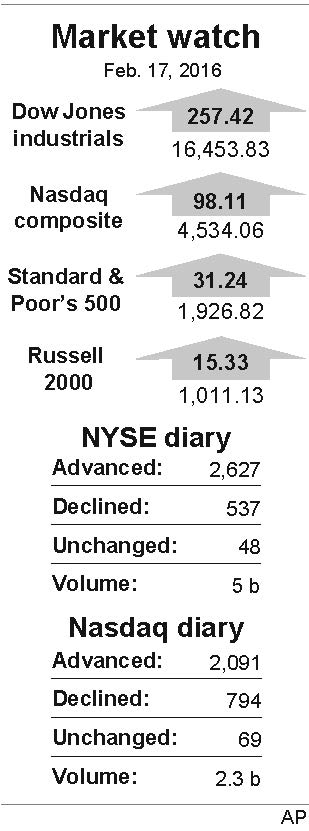

The Dow Jones industrial average gained 257.42 points, or 1.6 percent, to 16,453.83. The S&P 500 rose 31.24 points, or 1.7 percent, to 1,926.82. The Nasdaq composite index jumped 98.11 points, or 2.2 percent, to 4,534.06.

The price of oil recovered as investors again hoped for an international deal that will cap or cut production. Several OPEC nations are in talks about freezing production at January’s levels, but that deal requires all of OPEC’s members to agree, and Iran said Wednesday that it won’t stop increasing its exports. Still, investors appeared to be encouraged that the countries are talking.

The price of U.S. crude jumped $1.62, or 5.6 percent, to $30.66 a barrel in New York. Brent crude, a benchmark for international oils, rose $2.32, or 7.2 percent, to $34.50 a barrel in London.

U.S. crude soared Friday on anticipation of a deal, but even with the recent gains, it’s still down 17 percent this year.

Energy stocks climbed along with the price of oil. Chevron rose $3.50, or 4.1 percent, to $88.31 and Hess picked up $2.63, or 6.4 percent, to $43.47. Tech stocks made big gains, led by Microsoft, which added $1.33, or 2.6 percent, to $52.42, and Facebook, which rose $3.59, or 3.5 percent, to $105.20.

While corporate earnings have been shaky, companies that surpassed analysts’ expectations were rewarded on Wednesday.

U.S. factories cranked out more cars, furniture and food in January. The Federal Reserve said factory output rose 0.5 percent, the biggest increase since July. Output had fallen in four of the previous five months, and the data suggests U.S. manufacturing may be recovering after struggling last year. While the strong dollar and weak overseas growth have cut into exports and corporate profits, Americans are spending at a solid pace.

In other energy trading, wholesale gasoline rose 3.3 cents to $1 a gallon. Heating oil rose 6.1 cents, or 5.9 percent, to $1.088 a gallon. Natural gas added 3.9 cents, or 2 percent, to $1.942 per 1,000 cubic feet.

The price of gold rose $3.20 to $1,211.40 an ounce and silver inched up 4.3 cents to $15.377 an ounce. Copper added 2.5 cents to $2.076 a pound.

European stocks also rallied. Germany’s DAX rose 2.7 percent and France’s CAC 40 gained 3 percent. Britain’s FTSE 100 picked up 2.9 percent. Asian stocks slumped, however. Japan’s Nikkei 225 fell 1.4 percent as investors shrugged off data showing strong machinery orders in January. Hong Kong’s Hang Seng dropped 1 percent while the Shanghai Composite rose 1.1 percent.

The yield on the 10-year Treasury note jumped to 1.82 percent from 1.78 percent. The dollar slipped to 113.77 yen from 113.88 yen. The euro slipped to $1.1139 from $1.1144.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.