U.S. Stocks Slide Further On Global Economic Worries

Jitters over the global economy and steep declines in bank stocks knocked U.S. stocks lower for the fourth day in a row Thursday.

Jitters over the global economy and steep declines in bank stocks knocked U.S. stocks lower for the fourth day in a row Thursday.

The slide in the U.S. followed large losses worldwide and left all three major U.S. indexes down at least 10 percent since Jan 1.

The latest slump reflected heightened concerns that global economic growth is slowing, even as Federal Reserve Chair Janet Yellen reiterated her confidence in the U.S. economy in testimony to congress Thursday.

Financial companies were among the biggest decliners amid growing anxiety that interest rates in the U.S. and elsewhere would remain low and sap bank profits. The price of oil tumbled to $26.21, its lowest level since May 2003. Investors fled to the traditional havens of bonds and precious metals. Gold jumped 4.5 percent.

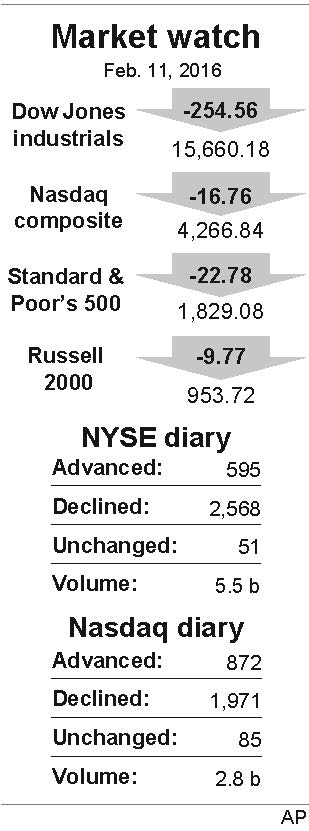

While stocks ended lower, they recovered somewhat from far steeper losses earlier in the day. The& Dow& Jones industrial average dropped 254.56 points, or 1.6 percent, to 15,660.18. The average had been down as much as 411 points.

The Standard & Poor’s 500 lost 22.78 points, or 1.2 percent, to 1,829.08. The Nasdaq composite fell 16.76 points, or 0.4 percent, to 4,266.84.

Investors have become increasingly worried that the mounting market turmoil could put a brake on the global economy at a time it is already struggling with a litany of issues, including China’s slowdown and low inflation.

Yellen, in her second day of testimony before U.S. lawmakers Thursday, acknowledged that global economic pressures pose risks to the U.S. economy, but said it’s too early to tell whether those risks are severe enough to alter the central bank’s interest-rate policies.

All 10 sectors in the S&P 500 index closed lower. Financial stocks fell the most, down 3 percent.

Citigroup fell $2.43, or 6.5 percent, to $34.98, while Bank of America shed 82 cents, or 6.8 percent, to $11.16. JPMorgan slid $2.45, or 4.4 percent, to $53.07.

Benchmark U.S. crude oil fell for the sixth day in a row, sliding $1.24, or 4.5 percent, to $26.21 a barrel in New York. Brent crude, a benchmark for international oils, dropped 78 cents, or 2.5 percent, to $30.06 a barrel in London. Natural gas fell 5 cents, or 2.5 percent, to $1.99 per 1,000 cubic feet.

In Europe, Germany’s DAX dropped 2.9 percent, while France’s CAC 40 slid 4.1 percent, dragged down by a 13 percent drop in the shares of bank Societe Generale, which warned about its profits. Britain’s FTSE 100 shed 2.4 percent.

In Asia, some indexes reopened after a holiday and caught up with several days of market turmoil.

Bond prices rose, driving the yield on the 10-year Treasury down to 1.66 percent from 1.71 percent late Wednesday.

Gold surged $53, or 4.5 percent, to $1,247.80 an ounce, while silver climbed 51 cents, or 3.4 percent, to $15.79 an ounce. Copper, an industrial metal that will often rise and fall along with investor’s optimism about the global economy, fell 2 cents, or 1 percent, to $2.01 a pound.

In other energy trading in New York, wholesale gasoline was little changed at 94 cents a gallon and home heating oil was flat at 98 cents a gallon.

The dollar took a dive as investors adjusted their expectations for fewer interest rate increases in the U.S. It fell to 112.27 yen from 113.68 yen. It also fell against the euro, which was up to $1.1330 from $1.1277.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.