Energy, Mining Stocks Lead A Decline on Wall Street

U.S. stocks closed modestly lower on Monday as a deepening slump in crude oil prices pulled down energy and mining stocks on a lighter than usual day of trading.

U.S. stocks closed modestly lower on Monday as a deepening slump in crude oil prices pulled down energy and mining stocks on a lighter than usual day of trading.

Chevron fell 1.8 percent, the most in the& Dow& Jones industrial average. Consol Energy sank 9 percent.

After recovering a bit last week, U.S. crude oil fell 3 percent amid reports that Iran intends to increase exports by 500,000 barrels per day once economic sanctions are removed. That would only add to excess global supplies that have helped depress oil prices.

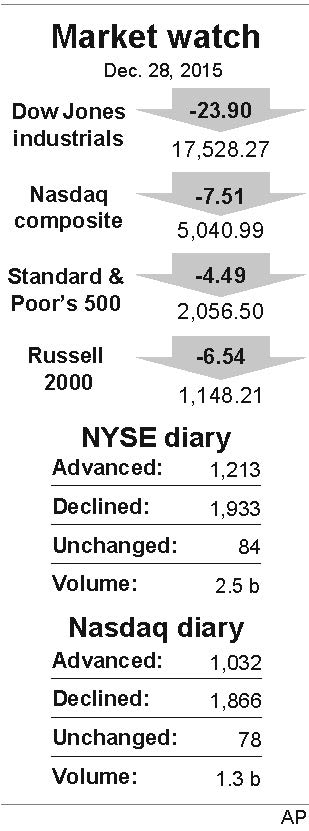

The& Dow& lost 23.90 points, or 0.1 percent, to 17,528.27. The Standard & Poor’s 500 index fell 4.49 points, or 0.2 percent, to 2,056.50. The Nasdaq composite shed 7.51 points, or 0.2 percent, to 5,040.99.

With less than a week to go in 2015, the& Dow& is down 1.7 percent for the year, while the S&P 500 is essentially flat with a loss of 0.1 percent. The Nasdaq is up 6.4 percent for the year.

The three major indexes were headed lower from the start of regular trading on Monday and didn’t shift out of negative territory the rest of the day.

Energy and mining companies felt the brunt of the sell-off.

Chevron fell $1.69 to $90.36, while Exxon Mobil lost 59 cents, or 0.7 percent, to $78.74. Consol Energy tumbled 78 cents to $7.87, while Chesapeake Energy slid 38 cents, or 8.5 percent, to $4.07.

Mining company Freeport-McMoRan sank 9.5 percent following news that James R. Moffett, the company’s executive chairman and co-founder, is stepping down. Plunging commodity prices have led to mass layoffs across the entire industry. The move follows the recent revelation that activist investor Carl Icahn has taken a huge stake in the company. The stock shed 72 cents to $6.85.

Six of the 10 sectors in the S&P 500 index moved lower. Energy stocks fell the most, 1.8 percent. The sector is down 23.2 percent this year. Consumer discretionary stocks fared the best, gaining 0.3 percent. That sector is the best performer so far this year, up 9.1 percent.

Benchmark U.S. crude shed $1.29, or 3.4 percent, to close at $36.81 per barrel on the New York Mercantile Exchange. Brent crude, which is used to price international oils, lost $1.27, or 3.4 percent, to close at $36.62 per barrel in London.

Among other energy futures trading, wholesale gasoline fell 0.3 cents to close at $1.233 a gallon, heating oil fell 1 cent to close at $1.09 a gallon and natural gas rose 20 cents to close at $2.228 per 1,000 cubic feet.

Major stock indexes in Europe also ended lower on Monday. Germany’s DAX fell 0.7 percent, while France’s CAC 40 was off 1 percent.

Trading in Asian markets was mixed. Japan’s Nikkei added 0.6 percent, while the Shanghai Composite Index lost 2.6 percent. Hong Kong’s Hang Seng slipped 1 percent. The London Stock Exchange remained closed for the vacation break.

Precious and industrial metals prices ended broadly lower. Gold slipped $7.60 to $1,068.30 an ounce, silver dropped 50 cents to $13.88 an ounce and copper fell five cents to $2.08 a pound.

Bond prices rose. The yield on the 10-year U.S. Treasury note fell to 2.23 percent from 2.25 percent. The dollar slipped to 120.36 yen while the euro fell to $1.0971.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.