Stocks Slide as a Late Tumble Erases Post-Fed Gains

Stocks skidded Thursday as a late drop erased the market’s gains from the day before. Companies that sell oil, gold and silver tumbled along with the prices of those commodities.

Stocks skidded Thursday as a late drop erased the market’s gains from the day before. Companies that sell oil, gold and silver tumbled along with the prices of those commodities.

Thursday’s slide marked the end of a three-day winning streak. Indexes drifted lower in the morning and fell sharply in the final minutes of trading. Energy stocks fell as the price of oil slumped again, and lower metals prices hurt mining companies.

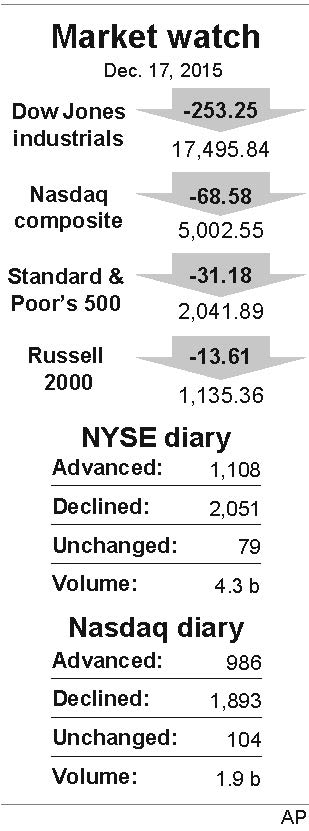

The& Dow& Jones industrial average sank 253.25 points, or 1.4 percent, to 17,495.84. The Standard & Poor’s 500 lost 31.18 points, or 1.5 percent, to 2,041.89. The Nasdaq composite index gave up 68.58 points, or 1.4 percent, to 5,002.55.

Energy and mining stocks have been pummeled this year as the sluggish global economy reduces demand even as supplies become more abundant. U.S. crude fell 57 cents, or 1.6 percent, to $34.95 a barrel in New York. It had not closed beneath $35 since Feb. 18, 2009 and traded above $60 a barrel as recently as June.

Chevron lost $2.90, or 3.1 percent, to $90.54 and Marathon Oil lost $1, or 7.3 percent, to $12.78.

Natural gas, which has fallen to 16-year lows, gave up another 3.5 cents, or 2 percent, to $1.755 per 1,000 cubic feet. The price of natural gas has tumbled as demand has collapsed. Thanks to the warm weather, customers haven’t needed much gas to heat their homes this winter. And demand from industrial customers has been weak.

Metals prices gave up their gains from Wednesday. The price of gold fell $27.20, or 2.5 percent, to $1,049.60 an ounce and silver sank 54.5 cents, or 3.8 percent, to $13.703 an ounce. Copper fell 2.8 cents, or 1.4 percent, to $2.044 a pound.

Among mining stocks, Newmont Mining dropped $1.47, or 7.7 percent, to $17.61.

Only utility stocks traded higher. Utilities have also struggled this year, but including a tiny gain Thursday, they have risen for four days in a row and are up 4 percent over that time. Utility stocks are seen as steady performers that pay regular dividends, and some investors think payments are going to increase. Duke Energy rose 47 cents to $70.50 and Ameren Corp. gained $1.03, or 2.4 percent, to $44.03.

Shipping company FedEx said its quarterly profit grew as online shopping increased and costs in its express-delivery business came down. FedEx also said it thinks year-end shipments will rise by more than 12 percent from a year ago. FedEx rose $3.01, or 2 percent, to $151.84.

Business software maker Oracle had its worst day in more than two years. The shares declined $1.98, or 5.1 percent, to $36.93.

The dollar climbed. While the Fed is raising interest rates, central banks in Europe and Japan are planning to lower them. That will make the dollar even stronger. A strong dollar hurts U.S. exporters but makes imports cheaper.

The euro dropped to $1.0805 from $1.0970. The dollar rose to 122.85 yen from 121.85 yen.

U.S. government bond prices rose. The yield on the 10-year Treasury note fell to 2.23 percent from 2.30 percent late Wednesday.

In other energy trading, Brent crude, a benchmark for international oils, fell 33 cents, or 0.9 percent, to $37.06 a barrel in London. The price of wholesale gasoline rose 2.9 cents, or 2.3 percent, to $1.262 a gallon in New York. Heating oil slipped 0.7 cents to $1.105 a gallon.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.