Retail Gets Slammed as Stocks Have Second-Worst Week of Year

The stock market slumped to its second-biggest weekly loss of the year Friday, breaking a streak of six consecutive weeks of gains. Fears that the end-of-the-year shopping season will be a dud tanked retail stocks.

The stock market slumped to its second-biggest weekly loss of the year Friday, breaking a streak of six consecutive weeks of gains. Fears that the end-of-the-year shopping season will be a dud tanked retail stocks.

Retailers ranging from department stores to dollar stores plunged after Nordstrom posted disappointing third-quarter results, just as Macy’s did earlier this week.

The price of oil continued to slide on evidence that global supplies are still rising. The dollar could get even stronger, further pressuring oil and other commodities and affecting mining and energy companies.

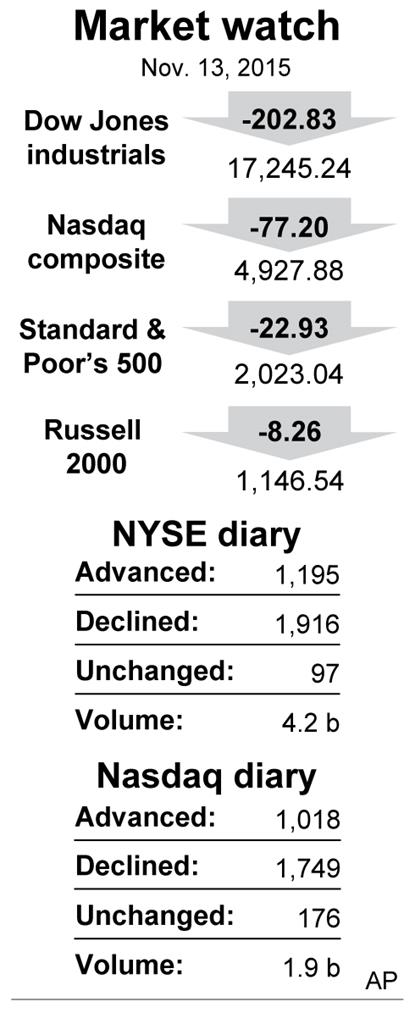

The Dow Jones industrial average fell 202.83 points, or 1.2 percent, to 17,245.24. The Standard & Poor’s 500 gave up 22.93 points, or 1.1 percent, to 2,023.04. The Nasdaq composite index slipped 77.20 points, or 1.5 percent, to 4,927.88.

Concerns about retail sales and skidding commodities prices eroded the gains from October’s stock market rally. Stocks have now lost ground seven of the last eight days. Overall the S&P 500 is down almost 2 percent for the year.

Nordstrom sank $9.51, or 15 percent, to $53.96 after reporting weaker sales. The company also cut its forecast for the year. Macy’s had done the same on Wednesday.

The end-of-the-year shopping rush will kick into high gear with Black Friday in two weeks. Following several weak reports from retailers, investors are becoming worried that sales will be poor during that period, which is a crucial moneymaker for retail companies. Macy’s and Nordstrom both hit two-year lows Friday. Consumer discretionary stocks were by far the worst performing group in the S&P 500.

Compounding those worries was a government report showing that U.S. retail spending edged up just 0.1 percent in October, a bit less than analysts expected. Prices charged by farmers, manufacturers and other producers fell in October. The figures show there is little sign of inflation in the U.S. economy. When inflation is higher, consumers have an incentive to spend more money.

U.S. crude slumped $1.01, or 2.4 percent, to $40.74 a barrel in New York. It dropped about 13 percent this month and is at its lowest price since late August. Brent crude, which is used to price international oils, lost 45 cents, or 1 percent, to $43.61 a barrel in London.

Jim Ritterbusch of the oil trading firm Ritterbusch & Associates said crude could fall another $3 to $4 a barrel.

In other energy trading, heating oil fell 2.5 cents to $1.381 a gallon. Wholesale gasoline dipped 3.4 cents to $1.239 a gallon. Natural gas edged up 10.1 cents to $2.361 per 1,000 cubic feet.

The price of gold fell 10 cents to $1,080.90 an ounce. Silver fell for the tenth day in a row, losing 2.1 cents to $14.20 an ounce. Copper dipped slightly to just under $2.17 a pound. All three metals are at their lowest levels in six years.

Generic drugmaker Mylan climbed after a long pursuit of Irish drugmaker Perrigo came to an end. Perrigo’s shareholders rejected a $26 billion offer from Mylan, an offer Perrigo had called inadequate. Mylan logged the biggest gain on the S&P 500, adding $5.58, or 12.9 percent, to $48.78. Perrigo fell $9.65, or 6.2 percent, to $146.90.

U.S. government bond prices rose. The yield on the 10-year Treasury note slipped to 2.27 percent from 2.31 percent. The euro declined to $1.0751 from $1.0791 and the dollar edged up to $122.67 yen from 122.62 yen.

This article appeared in print on page 12 of edition of Hamodia.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.