Tech Stocks Lead a Rally; S&P 500 Turns Positive for Year

U.S. stocks closed higher on Friday, delivering their second gain in two days and pushing the Standard & Poor’s 500 index back into positive territory for the year.

U.S. stocks closed higher on Friday, delivering their second gain in two days and pushing the Standard & Poor’s 500 index back into positive territory for the year.

Strong quarterly earnings from several big-name technology companies helped rally the market, which has been gradually regaining ground following a swoon in August and September. Microsoft vaulted to a 15-year high, while Amazon and Google’s parent company Alphabet closed sharply higher.

Investors also welcomed an interest rate cut by China’s central bank and the possibility of more economic stimulus for Europe.

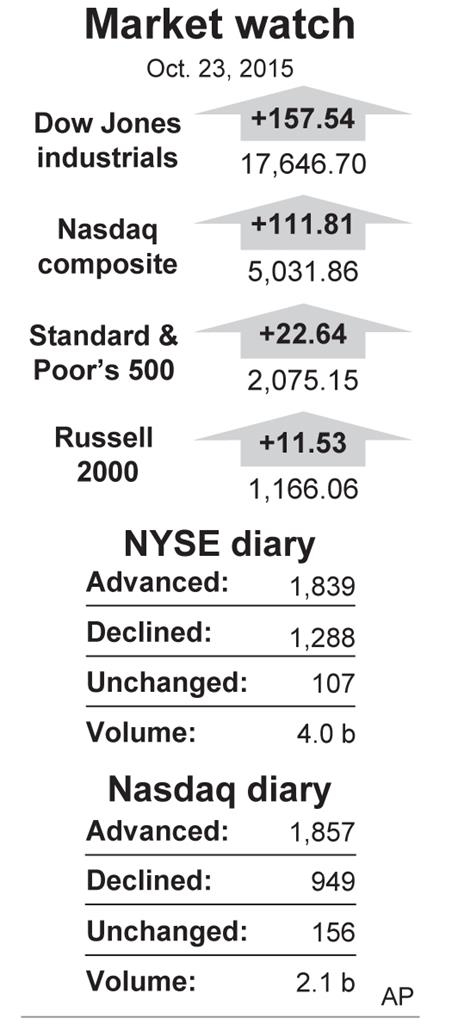

The Nasdaq composite, which is heavily weighted with technology stocks, rose 111.81 points, or 2.3 percent, to 5,031.86.

The Dow Jones industrial average rose 157.54 points, or 0.9 percent, to 17,646.70. The S&P 500 index climbed 22.64 points, or 1.1 percent, to 2,075.15.

The gains pushed the Nasdaq up 6.3 percent for the year. The S&P 500 index is now up 0.8 percent. The Dow is down 1 percent.

The stock indexes notched healthy gains early on Friday, as investors bid up shares in Microsoft, Amazon and Alphabet a day after the three tech giants reported surprisingly strong quarterly results.

The market action in the U.S. followed a rally in European and Asian stock markets as traders welcomed new action by China’s central bank and the possibility of more stimulus for Europe.

Next week, the spotlight turns to the world’s other big central banks, the Federal Reserve and the Bank of Japan, which are holding policy meetings at which officials will undoubtedly factor the ECB’s intentions into their own outlooks.

Six of the 10 sectors in the S&P 500 index moved higher, led by technology stocks. The sector rose 3 percent and is up 6.6 percent this year. Utilities stocks declined the most, sliding 1.8 percent and extending its loss for the year to 5.7 percent.

While only about a quarter of the companies in the S&P 500 index have reported results this earnings season, the market has seen some encouraging signs so far. Some companies failed to live up to expectations Friday.

Pandora Media tumbled 35.4 percent after the company reported a loss for the third quarter and gave a weak outlook. The stock lost $6.80 to $12.39. Skechers U.S.A. slumped 31.5 percent after the shoe company’s revenue disappointed Wall Street. The stock slid $14.55 to $31.64.

Overseas, Germany’s DAX gained 2.9 percent, while France’s CAC 40 rose 2.5 percent Britain’s FTSE 100 climbed 1.1 percent. Japan’s Nikkei 225 jumped 2.1 percent, while South Korea’s Kospi gained 0.9 percent. Hong Kong’s Hang Seng added 1.3 percent.

Benchmark U.S. crude fell 78 cents to $44.60 a barrel on the New York Mercantile Exchange. Brent Crude fell 9 cents to $47.99 a barrel in London.

Wholesale gasoline fell 0.3 cents to close at $1.304 a gallon, heating oil fell 1.1 cents to close at $1.454 a gallon and natural gas fell 10 cents to close at $2.286 per 1,000 cubic feet.

Gold fell $3.30 to $1,162.80 an ounce, silver slipped a penny to $15.83 an ounce and copper declined 3 cents to $2.35 a pound.

U.S. government bond prices fell. The yield on the 10-year Treasury note rose to 2.09 percent from 2.03 percent the day before.

The dollar rose to 121.41 yen. The euro fell to $1.1009.

This article appeared in print on page 8 of edition of Hamodia.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.