Nasdaq 5,000: Index Passes Dot-Com Milestone After 15 Years

For the first time since its dot-com era peak nearly 15 years ago, the Nasdaq composite has closed above 5,000.

For the first time since its dot-com era peak nearly 15 years ago, the Nasdaq composite has closed above 5,000.

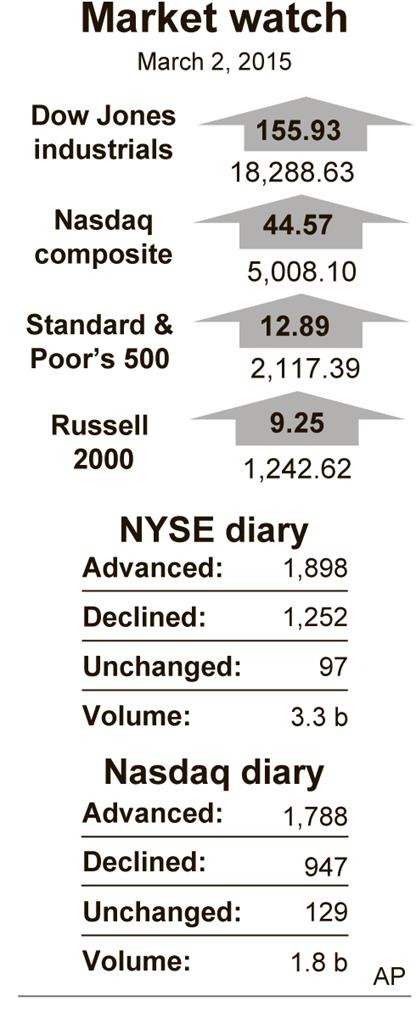

Major U.S. indexes rose from the start, with the Nasdaq passing the milestone number shortly before noon. The tech-heavy index then dropped, but rose again toward the close of trading to end at 5,008.10 on Monday, just 40 points from its March 2000 record. Merger news and an encouraging economic report drove the gains.

The long climb back for the Nasdaq, once a symbol of investor recklessness and self-delusion, has been marked by significant changes in its composition. Telecommunications stocks now represent less than 1 percent of the index, versus 12 percent in 2000. Gone also is the heavy reliance on Internet companies with little or no earnings.

As a result, valuations are more modest.

Investors are now paying $20 for every $1 in earnings per share thrown off by Nasdaq companies each year. During the dot-com frenzy, they were willing to pay $194 for every dollar.

On Monday, investors cheered a government report that showed household incomes rose in January, though consumer spending fell. Consumer discretionary stocks rose 1.2 percent on the news, the most of the 10 industry sectors of the Standard and Poor’s 500 index.

The S&P 500 closed up 12.89 points, or 0.6 percent, to 2,117.39. The Dow Jones industrial average rose 155.93 points, or 0.9 percent, to 18,288.63. The Nasdaq rose 44.57 points, or 0.9 percent.

The broad gains for all three indexes on Monday, the first day of trading for March, came after the best monthly advance for stocks in more than three years. The S&P 500 climbed 5.5 percent in February, its biggest gain since October 2011.

Household income after taxes shot up 0.9 percent in January, the biggest gain in two years.

Investors also were watching developments overseas. The People’s Bank of China cut interest rates for the second time in three months on Saturday, trimming the rate for one-year commercial loans to 5.35 percent.

Other stocks making big moves included Sotheby’s, which sank after the auction house posted a big drop in quarterly earnings. Higher expenses weighed on the company’s profits, which came in below analysts’ estimates. Sotheby sank 61 cents, or 1.4 percent, to $43.34.

Visa rose $6.98, or 2.6 percent, to $278.29 after Costco said it would be the only credit card accepted at its stores.

In the bond market, prices for U.S. government bonds fell, pushing yields up. The yield on the 10-year Treasury note rose to 2.08 percent from 2 percent late Friday.

The price of oil fell on reports of rising OPEC output, including from a large field in Libya that recently re-started production. Benchmark U.S. crude fell 17 cents to close at $49.59 a barrel in New York. Brent crude, a benchmark for international oils used by many U.S. refineries, fell $3.04 to close at $59.54 in London.

In other futures trading on the NYMEX, wholesale gasoline fell 8.1 cents to close at $1.897 a gallon. Heating oil dipped 8.7 cents to close at $1.887 a gallon. Natural gas slipped 3.6 cents to close at $2.698 per 1,000 cubic feet.

Precious and industrial metals ended mixed. Gold dropped $4.90 to settle at $1,208.20 an ounce, while silver slipped 11 cents to $16.45 an ounce. Copper picked up a penny to $2.70 a pound.

This article appeared in print on page 8 of edition of Hamodia.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.