Stocks Fade Late Over New Greece Worries

The U.S. stock market sagged in the final half-hour of trading on Wednesday after Europe’s central bank withdrew a key financial support for Greek banks. The price of oil plunged, dragging down energy stocks.

The U.S. stock market sagged in the final half-hour of trading on Wednesday after Europe’s central bank withdrew a key financial support for Greek banks. The price of oil plunged, dragging down energy stocks.

The European Central Bank late in the day said that Greek banks could no longer access ECB credit using government bonds or bonds guaranteed by the government as collateral for loans.

The move unsettled investors and knocked most U.S. indexes lower.

Major U.S. indexes got off to a weak start Wednesday as a renewed drop in crude oil tugged down shares of energy companies. The Standard & Poor’s 500 recovered its losses by midday, meandered through the afternoon, then swung from a solid gain to a slight loss in the market’s last 30 minutes following the announcement from the ECB.

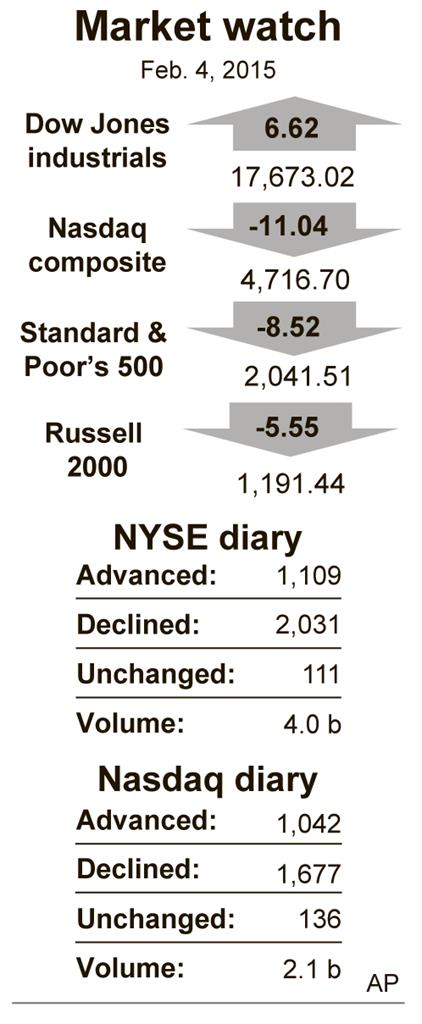

The Standard & Poor’s 500 index fell 8.52 points, or 0.4 percent, to 2,041.51.

The Dow eked out a gain of 6.62 points, or less than 0.1 percent, to 17,673.02 and the Nasdaq sank 11.03 points, or 0.2 percent, to 4,716.70.

The Dow gave up nearly all of a 115-point advance. U.S. government bond prices also rose, pushing yields lower, as traders moved money into safe-haven investments. A big gain in Disney’s stock after that company reported stronger earnings helped the blue-chip index.

The fourth-quarter earnings season now looks better than it did just two weeks ago. Nearly three out of four big companies have turned in higher profits than analysts had expected, putting overall earnings on track to rise nearly 7 percent for the quarter, according to S&P Capital IQ. Two weeks ago, the expected increase was just 4 percent.

A recent rebound in oil prices fizzled out Wednesday as the benchmark contract for U.S. crude fell $4.60, or 8.7 percent, to settle at $48.45 a barrel in New York. The drop came after the U.S. government reported an increase in crude inventories last week.

Oil had rallied over the previous four days as traders speculated that low prices would force more energy companies to curtail exploration and production. Brent crude, a benchmark for international oils used by many U.S. refineries, declined $3.75, or 6.5 percent, to close at $54.16 a barrel in London.

Major markets in Europe ended mixed. France’s CAC 40 rose 0.4 percent and Germany’s DAX edged up 0.2 percent. Britain’s FTSE 100 closed with a loss of 0.2 percent.

On Tuesday, Greece’s stocks and bonds rallied on optimism that the country’s new leftist government would make progress with international creditors on negotiating new terms for its financial rescue program.

In the U.S., Staples announced that it’s buying Office Depot for $6 billion in a widely anticipated merger of the two largest office supply retailers. The cash-and-stock deal comes a little more than a year after Office Depot merged with OfficeMax and still needs approval from regulators. Staples dropped $2.28, or 12 percent, to $16.73.

Prices rose in the market for U.S. government bonds, pushing the yield on the 10-year Treasury note down to 1.75 percent. The yield had been as high as 1.84 percent before the ECB announcement.

In the commodity markets, gold rose $4.20 to $1,264.50 an ounce, while silver rose seven cents to $17.40 an ounce. Copper edged up a penny to $2.59 a pound.

This article appeared in print on page 8 of edition of Hamodia.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.