U.S. Stocks Head Lower; Crude Oil Price Falls Again

Falling oil prices dragged the stock market lower on Monday as Exxon Mobil, Chevron and other big energy companies sank along with crude.

Falling oil prices dragged the stock market lower on Monday as Exxon Mobil, Chevron and other big energy companies sank along with crude.

The steep drop in oil prices over recent months has investors second-guessing expectations for the quarterly earnings season that starts this week.

The Standard & Poor’s 500 index lost 16.55 points, or 0.8 percent, to close at 2,028.26.

The Dow Jones industrial average slid 96.53 points, or 0.5 percent, to 17,640.84, and the Nasdaq composite lost 39.36 points, or 0.8 percent, to 4,664.71.

In a wide-ranging note to clients, Goldman Sachs slashed its forecast for oil prices. It now estimates that that crude will average $50.40 a barrel this year, far below its previous forecast of $83.75. It also trimmed its forecast for Brent crude, a type used in international markets, to $70 a barrel from $90.

Oil prices extended their slide, with U.S. crude losing $2.29 to settle at $46.07 a barrel. Brent lost $2.68 to $47.43. Both trade at their lowest levels since March of 2009.

Monday also marked the unofficial start to the fourth-quarter earnings season as Alcoa turned in its latest quarterly results after the closing bell. The aluminum producer reported stronger earnings and revenue than Wall Street expected, pushing the stock up 20 cents, or 1 percent, to $16.38 in extended trading.

Analysts expect big corporations to turn in modest results for the fourth-quarter, forecasting earnings growth of 4.6 percent, according to S&P Capital IQ. Overall sales are expected to be meager, rising 2.3 percent, largely the result of sliding revenue for oil companies.

Traders are also looking ahead to Greece’s general election on Jan. 25. Opinion polls show the Syriza party on track to win the election. Syriza wants to change the terms of the country’s bailout agreement with lenders, but few think it will be able to govern without the support of other parties. Diminishing fears that Greece will drop the euro currency have helped take some pressure off the country’s bond market.

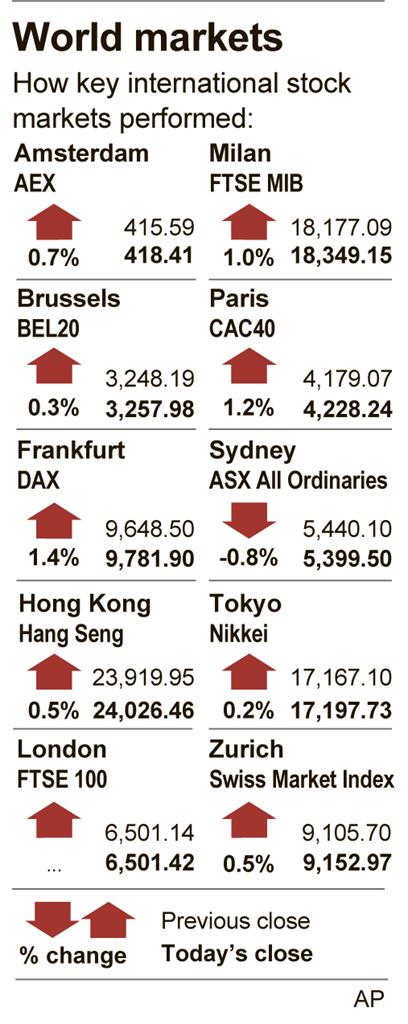

Major markets in Europe climbed. Germany’s DAX gained 1.4 percent, while France’s CAC-40 added 1.2 percent. Britain’s FTSE 100 closed flat.

Back in the U.S., Tiffany & Co. cut its outlook for annual profits and posted weaker sales in the end-of-year season, partially the result of a stronger U.S. dollar pinching results. The jewelry retailer’s stock fell $14.44, or 14 percent, to $89.01, the biggest drop in the S&P 500.

AmerisourceBergen announced plans to buy MWI Veterinary Supply for roughly $2.5 billion, or $190 a share. The deal would give the prescription-drug distributer a foothold in the growing business of veterinary medicine. MWI’s stock jumped $14.35, or 8 percent, to $190, while AmerisourceBergen sank $2.07, or 2 percent, to $90.93.

In the bond market, prices for Treasurys rose, pushing the yield on the 10-year Treasury note down to 1.91 percent from 1.95 percent late Friday.

In commodity trading, the price of gold gained $16.70 to settle at $1,232.80 an ounce, and silver rose 15 cents to $16.56 an ounce. Copper fell three cents to $2.73 an ounce.

In other futures trading on the New York Mercantile Exchange:

Wholesale gasoline fell 4.8 cents to close at $1.275 a gallon.

Heating oil fell 4.9 cents to close at $1.654 a gallon.

This article appeared in print on page 10 of edition of Hamodia.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.