Stocks Close Higher for 4th Straight Day

The Federal Reserve’s latest economic update reversed a listless slide for stocks Wednesday, propelling the Standard & Poor’s 500 index to another record-high close.

The Federal Reserve’s latest economic update reversed a listless slide for stocks Wednesday, propelling the Standard & Poor’s 500 index to another record-high close.

The central bank’s statement reassure investors on two fronts: The Fed sees improvement in the U.S. job market and signs of just modest inflation, but it also intends to continue keeping short-term interest rates low, a policy that’s helped make stocks more attractive.

The market had been in a wait-and-see mode in advance of the Fed statement, drifting lower for much of the day. The afternoon rebound gave the stock market its fourth consecutive gain.

“The important thing is that the Federal Reserve has acknowledged that the unemployment rate seems to be coming down just a little bit faster than they expected,” said David Kelly, chief global strategist at J.P. Morgan Funds.

Major U.S. stock indexes were mostly flat in premarket trading Wednesday. They wavered through much of the morning then settled slightly in the red, where they held right up to the release of the Federal Reserve’s statement at 2:00 p.m. Eastern Time.

Stock investors appeared pleased with the Fed’s message that rates would remain low. That sent indexes up more than half a percentage point.

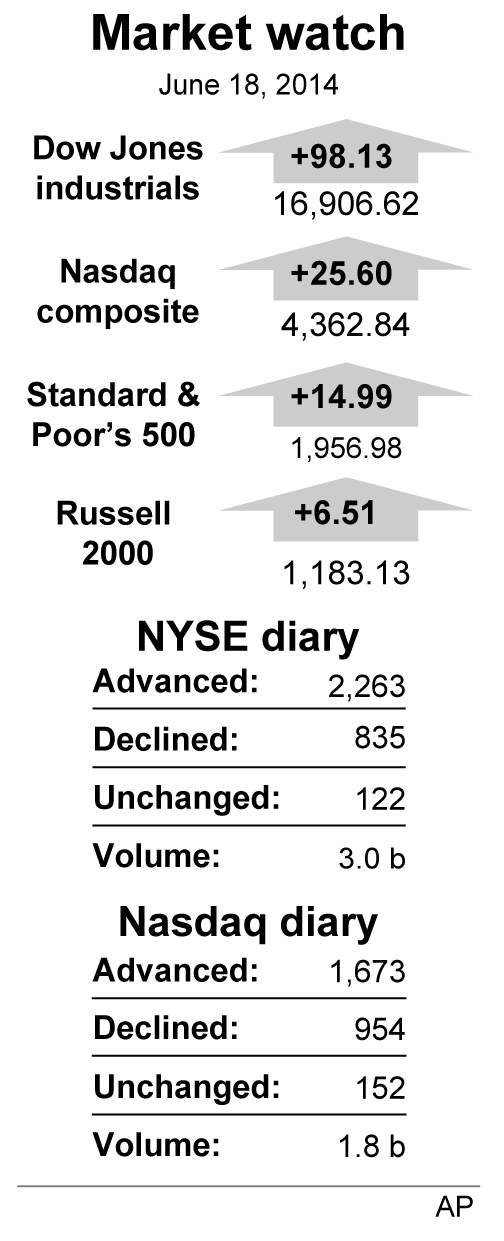

The Standard & Poor’s 500 index rose 14.99 points, or 0.8 percent, to 1,956.98, a record close. The most recent all-time high was 1,951.27 set early last week.

The Dow Jones industrial average added 98.13 points, or 0.6 percent, to 16,906.62. The Nasdaq composite gained 25.60 points, or 0.6 percent, to 4,362.84.

The three indexes are all up for the year.

The Fed expects the U.S. economy to grow just 2.1 percent to 2.3 percent this year, down from 2.8 percent to 3 percent in its last projections released in March.

At a news conference Wednesday, Fed Chair Janet Yellen said that despite a steadily improving job market and signs of creeping inflation, the Fed sees no need to raise short-term interest rates from record lows anytime soon.

The Fed statement also appeared to whet investors’ appetite for bonds. The yield on the 10-year Treasury note fell to 2.59 percent Wednesday from 2.65 percent late Tuesday.

Kelly noted that even if short-term interest rates rise to 2.5 percent by the end of 2016, it doesn’t make sense that long-term rates, as reflected by the yield on the 10-year Treasury note, are as low as they are.

“That’s a sign of excess demand in the bond market,” he said. “The message for investors is: Be careful. Because long-term interest rates are in the wrong place and they’ll likely gradually move up.”

Investors looking for yield continued to invest in utilities stocks Wednesday.

Utilities posted the biggest gain in the S&P 500 index’s 10 sectors, rising 2.2 percent. The sector is up more than 14 percent this year.

Among other stocks in the news Wednesday:

– FedEx gained $8.64, or 6.2 percent, to $148.95 after the company reported that its quarterly profit rose as growth in online shopping gave its ground-shipping business a boost. Earnings and revenue both topped Wall Street’s expectations.

– Air Products & Chemicals surged $9.12, or about 7.5 percent, to $130.72 after the specialty gas company announced it hired Rockwood’s Seifi Ghasemi as its new chairman and CEO to replace its retiring chief executive.

– Food maker ConAgra sank $2.38, or 7.2 percent, to $30.47 after it slashed its fourth-quarter earnings outlook, citing slumping sales for its consumer foods segment, as well as weak profits for its private brands unit.

This article appeared in print on page 8 of edition of Hamodia.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.