Home Depot 4Q Mixed, Boosts Quarterly Dividend

Home Depot’s fiscal fourth-quarter net income dipped 1 percent, hampered by bad winter weather and one less week in the period than a year ago.

Home Depot’s fiscal fourth-quarter net income dipped 1 percent, hampered by bad winter weather and one less week in the period than a year ago.

Still, cost cuts helped earnings top Wall Street’s view, and the No. 1 home-improvement retailer raised its quarterly dividend by 21 percent. Shares rose more than 2 percent in early trading.

The U.S. housing market has emerged from a deep slump, aided by rising home prices, steady job growth and fewer troubled loans dating back to the housing-bubble days. That has spurred customers to spend more to renovate their homes.

But some believe that the combination of anticipated higher interest rates, continued dampened availability of mortgages, and price increases for new homes from 2013 will tamp down housing demand this year. And that, in turn, might slow down spending on homes.

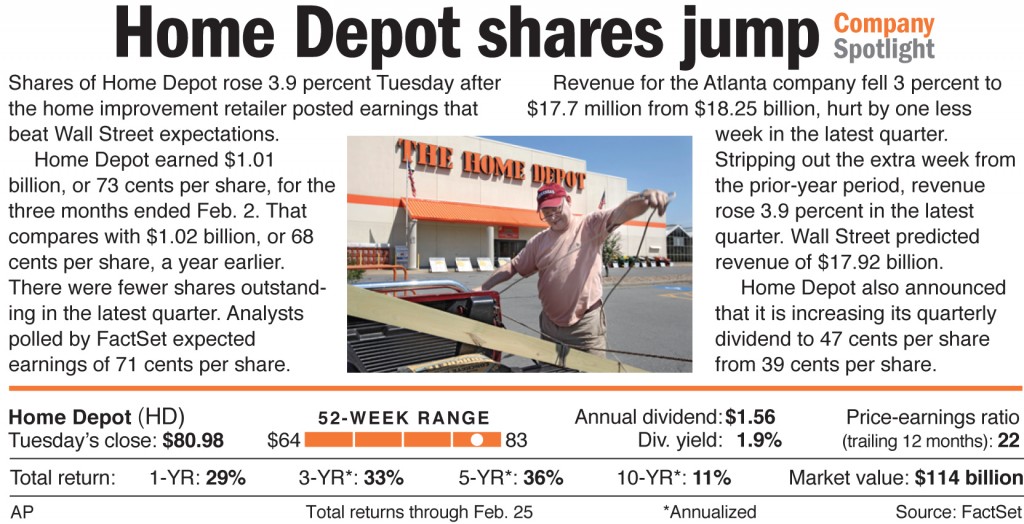

Home Depot Inc. earned $1.01 billion, or 73 cents per share, for the three months ended Feb. 2. That compares with $1.02 billion, or 68 cents per share, a year earlier. There were fewer shares outstanding in the latest quarter.

Analysts polled by FactSet expected earnings of 71 cents per share.

Revenue for the Atlanta company fell 3 percent, to $17.7 billion from $18.25 billion, hurt by one less week in the latest quarter. Stripping out the extra week from the prior-year period, revenue rose 3.9 percent in the latest quarter.

Wall Street had predicted revenue of $17.92 billion.

Home Depot said that fourth-quarter sales at stores open at least a year rose 4.4 percent. For stores in the U.S., the figure increased 4.9 percent.

This metric is a key indicator of a retailer’s health, because it excludes results from stores recently opened or closed.

Full-year net income rose to $5.39 billion, or $3.76 per share, from $4.54 billion, or $3 per share, in the previous year.

Annual revenue climbed 5 percent, to $78.81 billion from $74.75 billion.

Home Depot also announced Tuesday that it is increasing its quarterly dividend to 47 cents per share from 39 cents per share. The dividend will be paid on March 27 to shareholders of record on March 13.

Looking ahead, the retailer anticipates fiscal 2014 earnings of $4.38 per share. Revenue is expected to rise by about 4.8 percent. Based on 2013’s revenue of $78.81 billion, this implies approximately $82.6 billion.

Analysts forecast full-year earnings of $4.42 per share on revenue of $82.85 billion.

Home Depot’s smaller rival Lowe’s Cos. reports its quarterly results on Wednesday.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.