Stocks Around the World Take A Pause Ahead of Frenetic Week

Stocks retreated from their record highs on Monday, ahead of a frenetic week for markets.

Investors are waiting to learn who the next head of the Federal Reserve will be, what several of the world’s biggest central banks will decide on interest rates, and whether Apple and other big U.S. companies can keep piling their profits higher. In the meantime, reports continued to show that the economy is strengthening and negotiations continued in Washington to cut income-tax rates.

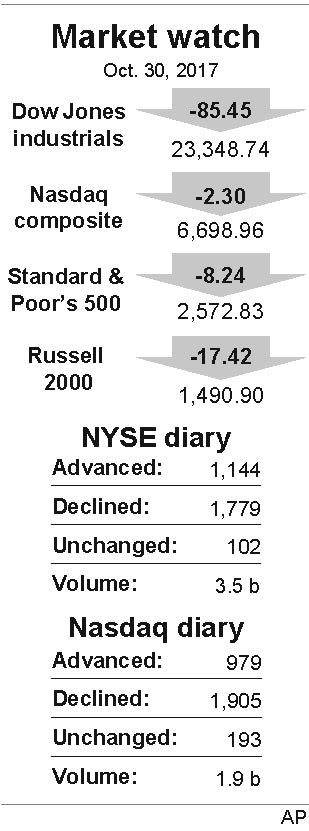

Amid the many cross currents, the Standard & Poor’s 500 index fell 8.24 points, or 0.3 percent, to 2,572.83 from its record set on Friday. Losses for health care stocks, telecoms and other areas of the market overshadowed gains for technology companies and energy producers.

The Dow Jones industrial average fell 85.45, or 0.4 percent, to 23,348.74, and the Nasdaq composite dropped 2.30, or less than 0.1 percent, to 6,698.96. Smaller stocks fell more than the rest of the market, and the small-cap Russell 2000 index lost 17.42, or 1.2 percent, to 1,490.90.

The Federal Reserve is scheduled to start a two-day meeting on Tuesday. Most investors expect the Fed to raise rates at its next meeting in December, which would be the third increase of the year.

Other central banks meeting this week include the Bank of Japan and the Bank of England.

This week will also see more than 100 companies in the S&P 500 index report their earnings results for July through September. Strong earnings growth has helped to drive the stock market higher, and tech stocks have been delivering some of the most consistent growth. They’ll likely need to continue to do so to justify their lofty stock prices. Tech giant Apple will report its results on Thursday.

Merck recorded one of the biggest losses in the S&P 500 on Monday after it withdrew an application to market its Keytruda cancer drug in Europe. Merck fell $3.53, or 6.1 percent, to $54.71.

Telecom stocks were also weak. Shares of Sprint and T-Mobile US plunged after a report from Nikkei in Japan said that Sprint’s majority owner, Softbank, wants merger negotiations between the companies called off. Sprint fell 65 cents, or 9.3 percent, to $6.34, and T-Mobile US lost $3.37, or 5.4 percent, to $59.58.

In overseas stock markets, the French CAC 40 was close to flat, Germany’s DAX added 0.1 percent and the FTSE 100 in London dipped 0.2 percent. Japan’s Nikkei 225 index was virtually flat, South Korea’s Kospi rose 0.2 percent and the Hang Seng in Hong Kong lost 0.4 percent.

In the commodities market, benchmark U.S. crude rose 25 cents to settle at $54.15 per barrel. Brent crude, the international standard, rose 46 cents to $60.90 a barrel.

Natural gas was close to flat at $2.97 per 1,000 cubic feet, heating oil added a penny to $1.88 per gallon and wholesale gasoline was close to flat at $1.76 per gallon.

Gold rose $5.90 to $1,277.70 per ounce, silver gained 10 cents to $16.85 per ounce and copper added a penny to $3.11 per pound.

The dollar dipped to 113.18 Japanese yen from 113.81 yen late Friday. The euro rose to $1.1637from $1.1599, and the British pound inched up to $1.3199from $1.3125.

Bond yields fell as prices for Treasurys rose. The yield on the 10-year Treasury note fell to 2.36 percent. The two-year yield dipped to 1.57 percent from 1.60 percent late Friday, and the 30-year yield sank to 2.88 percent from 2.92 percent.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.