Insurers Slump as Health Care Bill Fails; Tech Stocks Rise

U.S. stocks were divided Tuesday as health insurers declined after the failure of the latest Republican health care bill while a big jump in subscribers for Netflix sent technology and consumer-focused companies higher.

Stocks spent most of the day lower after the health care push stalled and several financial firms, including Goldman Sachs, reported underwhelming second-quarter results. Energy and industrial companies also slipped.

While stocks dealt with larger losses and most of the companies listed on the New York Stock Exchange fell, the gains for tech and consumer stocks were enough to send the Standard & Poor’s 500 index and Nasdaq composite to new highs.

Wall Street did not have a big reaction to the Republican health care defeat, as it did when a related bill failed in March. After four months of struggles over health care, investors don’t expect as much from Congressional Republicans and President Donald Trump on other issues.

“Tax changes aren’t likely to take place any time soon and are likely to be smaller than they hoped,” said Kate Warne, an investment strategist for Edward Jones.

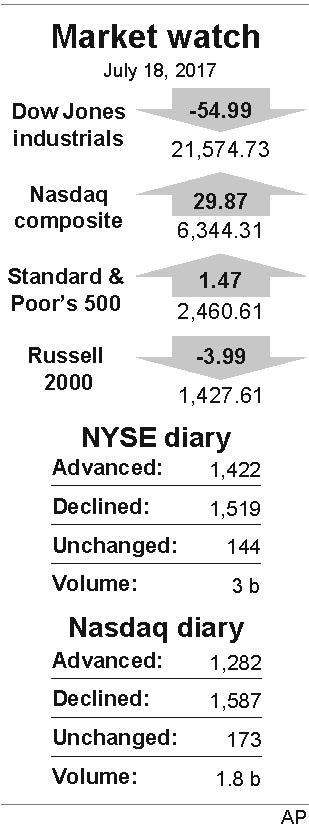

The S&P 500 rose 1.47 points, or 0.1 percent, to 2,460.61, just above the record it set Friday. The Dow Jones industrial average fell 54.99 points, or 0.3 percent, to 21,574.73. Goldman Sachs was responsible for almost all of that loss. The Nasdaq composite climbed 29.87 points, or 0.5 percent, to 6,344.31 as tech companies like Alphabet, the parent of Google, rose. After a plunge in June, the Nasdaq has surged over the last two weeks.

The Russell 2000 index of smaller-company stocks sank 3.99 points, or 0.3 percent, to 1,427.61. That index closed at an all-time high Monday.

Several major banks reported strong second-quarter results, but that wasn’t enough to get investors excited. Bank of America and Goldman Sachs both said their trading businesses struggled, as the market has been calm for months. Banks did very well in the first quarter, and Warne said investors may have been caught off guard that the second quarter doesn’t look as good for them.

“When they’re not benefiting as much as expected from higher interest rates, I think that makes investors more cautious about what results will look like going forward,” Warne said.

Goldman lost $5.95, or 2.6 percent, to $223.31 and Comerica fell $1.47, or 2 percent, to $73.05. Bank of America declined 12 cents to $23.90.

Netflix jumped after the company said it added 5.2 million subscribers over the last three months, and for the first time, it has more subscribers outside the U.S. than in it. The second quarter is usually a slow period for Netflix, so investors were pleased to see the big gain. Netflix gained $21.90, or 13.5 percent, to $183.60. Among other consumer companies, Amazon added $14.34, or 1.4 percent, to $1,024.38.

Alphabet picked up $10.99, or 1.1 percent, to $986.85.

Health insurers declined. Aetna fell $1.69, or 1.1 percent, to $153.31 and Anthem retreated $2.64, or 1.4 percent, to $189.45. UnitedHealth, the largest company in the industry, inched higher after it reported strong second-quarter results and raised its annual outlook. It gained 59 cents to $186.85.

The dollar slipped again. It has steadily lost ground for most of this year and the ICE U.S. dollar index is now at its lowest level since August. The dollar slid to 111.98 yen from 112.66 yen. The euro rose to $1.1563 from $1.1480. The euro hasn’t been this strong compared to the dollar since early 2015.

Bond prices rose. The yield on the 10-year Treasury note slid to 2.26 percent from 2.31 percent. That also hurt bank stocks.

Benchmark U.S. crude added 38 cents to $46.40 a barrel in New York.

Brent crude, the international standard, rose 42 cents to $48.84 a barrel in London.

Wholesale gasoline rose 2 cents to $1.58 a gallon. Heating oil added 1 cent to $1.51 a gallon. Natural gas added 7 cents to $3.09 per 1,000 cubic feet.

Gold gained $8.20 to $1,241.90 an ounce. Silver rose 17 cents, or 1 percent, to $16.27 an ounce.

Copper added 1 cent to $2.73 a pound.

The DAX in Germany dropped 1.2 percent and France’s CAC 40 fell 1.1 percent. The British FTSE 100 index slipped 0.2 percent. Japan’s benchmark Nikkei 225 lost 0.6 percent as the yen gained against the dollar. The Kospi in South Korea was flat. Hong Kong’s Hang Seng climbed 0.2 percent.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.