Skidding Tech and Retail Companies Take U.S. Stocks Lower

U.S. stocks fell Thursday as technology firms and small companies skidded. Investors bought high-dividend stocks, which pulled the market away from steeper losses.

Stocks dropped in early trading as investors reacted to rising interest rates in the U.S. while the Bank of England came unexpectedly close to raising U.K. interest rates for the first time in 10 years. Smaller, more domestically-oriented companies fell as investors wondered if the expanding special counsel investigation in Washington will affect President Trump’s proposed agenda of cuts in taxes and regulations.

Elsewhere, technology companies continued their recent slump, while shoe retailer Nike and toy maker Mattel both fell. But industrial companies rose on new signs U.S. manufacturing has steadied, and utilities and real estate companies did well.

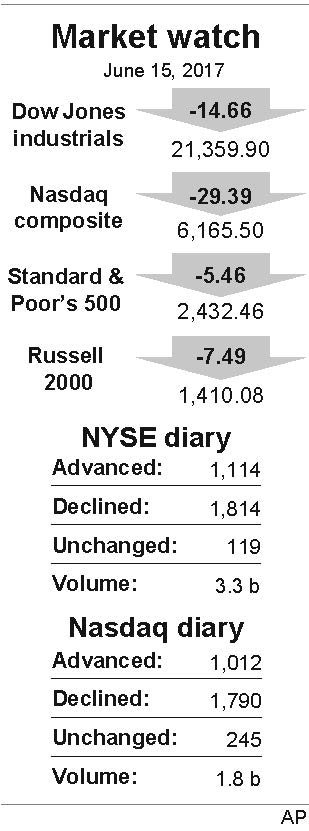

The Standard & Poor’s 500 index lost 5.46 points, or 0.2 percent, to 2,432.46. It fell as much as 19 points in the morning. The Dow Jones industrial average dipped 14.66 points, or 0.1 percent, to 21,359.90 after it closed at a record high Wednesday. The Nasdaq composite dropped 29.39 points, or 0.5 percent, to 6,165.50. The Russell 2000 index of small-company stocks fell 7.49 points, or 0.5 percent, to 1,410.08.

Technology companies, which have done far better than the rest of the market this year, continued to slide. Apple gave up 87 cents to $144.29 and Alphabet, Google’s parent company, sank $7.75 to $960.18. Symantec shed 68 cents, or 2.3 percent, to $28.41. The stocks have been slipping since Friday and the Nasdaq is on track for its second consecutive weekly loss.

Grocery chain Kroger took its biggest one-day loss since 1999. The company cut its annual profit outlook as it deals with growing competition from discount chain Aldi and from Lidl, a German chain opening its first locations in the U.S. Kroger’s stock plunged $5.72, or 18.9 percent, to $24.56.

As the dollar regained strength, the price of gold sank $21.30, or 1.7 percent, to $1,254.60 an ounce and silver lost 42 cents, or 2.5 percent, to $16.72 an ounce. Copper lost 1 cent to $2.57 a pound.

The Bank of England left interest rates alone, but came closer to raising interest rates than many expected. Three of the eight members of its Monetary Policy Members wanted to raise rates by a quarter-point. A growing number of its policy makers seem to be worried about a spike in inflation that is eating into the living standards of the British.

Germany’s DAX fell 0.9 percent while the FTSE 100 in Britain dropped 0.7 percent. The CAC-40 in France sank 0.5 percent. Japan’s Nikkei 225 stock index fell 0.3 percent and South Korea’s Kospi sank 0.5 percent. The Hang Seng in Hong Kong dropped 1.2 percent.

On Wednesday the Federal Reserve raised U.S. interest rates for the third time in about six months, and suggested it will raise rates again later this year.

Bond prices fell. The yield on the 10-year Treasury note rose to 2.16 percent from 2.13 percent. Stocks that pay large dividends, including utilities, real estate investment trusts and phone companies, did better than the rest of the market.

Benchmark U.S. crude fell another 27 cents to $44.46 a barrel in New York. Brent crude, used to price international oils, lost 8 cents to $46.92 a barrel in London.

Wholesale gasoline remained at $1.44 a gallon.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.