New Highs for Stocks; Dow Win Streak Longest Since 1987

Wall Street notched another set of milestones Monday as the Dow Jones industrial average closed at a record high for the 12th consecutive time, the longest winning streak for the 30-company average in 30 years.

The Standard & Poor’s 500 index, the benchmark favored by professional investors, also closed at a record high.

The latest push into the record books came on an indecisive day for U.S. stocks that sent indexes wavering between small gains and losses for much of the day. They ultimately eked out tiny gains, led by energy stocks, which climbed as the price of crude oil rose. Phone companies lagged the most.

Many investors were taking a wait-and-see approach ahead of President Donald Trump’s speech to Congress on Tuesday, hoping for details of promised tax cuts, infrastructure spending and other business-friendly policies.

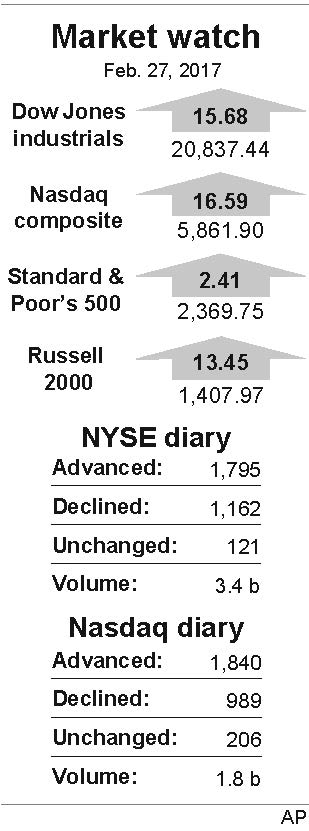

The Dow Jones industrial average rose 15.68 points, or 0.1 percent, to 20,837.44. The S&P 500 gained 2.39 points, or 0.1 percent, to 2,369.73. The Nasdaq composite index added 16.59 points, or 0.3 percent, to 5,861.90. Small-company stocks fared better than the other indexes, sending the Russell 2000 index up 13.44 points, or 1 percent, to 1,407.97.

U.S. stocks have benefited from the Trump administration’s promise of pro-business changes, but investors have become uneasy over how large and rapid those changes will be.

During a meeting with governors Monday, Mr. Trump noted that his upcoming budget would include a big boost to defense spending.

Talk of more defense spending gave a lift to defense contractors Monday. Raytheon added $1.35, or 0.9 percent, to $154.83. Northrop Grumman gained $3.55, or 1.4 percent, to $248.60. Lockheed Martin climbed $5.18, or 2 percent, to $269.36.

Expectations that the Trump administration will ramp up infrastructure spending projects also gave materials companies a boost. Martin Marietta Materials rose $5.21, or 2.5 percent, to $215.26, while Vulcan Materials added $2.78, or 2.4 percent, to $120.60. Summit Materials gained 50 cents, or 2.1 percent, to $24.25.

Consumer stocks were among the biggest decliners as shares in several supermarket operators fell. Kroger slid $1.07, or 3.2 percent, to $32.22, while Whole Foods Market dipped 46 cents, or 1.5 percent, at $31.10.

Major stock indexes overseas were mixed.

Benchmark U.S. crude rose 6 cents to close at $54.05 a barrel in New York. Brent crude, used to price international oils, slipped 6 cents to close at $55.93 in London.

Bond prices fell. The 10-year Treasury yield rose to 2.37 percent from 2.32 percent late Friday.

In Europe, Germany’s DAX rose 0.2 percent, while France’s CAC-40 was flat. London’s FTSE-100 added 0.1 percent. In Asia, Tokyo’s Nikkei 225 index fell 0.9 percent. Hong Kong’s Hang Seng slid 0.2 percent.

The dollar rose to 112.80 yen from Friday’s 111.98 yen. The euro rose to $1.0589 from $1.0565.

In other energy trading, wholesale gasoline added 2 cents to $1.53 a gallon, while heating oil was little changed at $1.64 a gallon. Natural gas futures shed 9 cents, or 3.4 percent, at $2.69 per 1,000 cubic feet.

Among metals, the price of gold edged up 50 cents to $1,258.80 an ounce. Silver added 2 cents to $18.35 an ounce. Copper rose a penny to $2.69 a pound.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.