Take a Breath: Stocks Slow Down After a Record-Setting Run

The Standard & Poor’s 500 index dipped Thursday to break a seven-day winning streak, its longest in three and a half years, though it remains a nudge away from its record high.

It was part of a pause for stock markets around the world, which have been on a torrid run thanks to an improving economy, stronger corporate earnings and hopes for more business-friendly policies from Washington. The dollar’s value also dipped against rival currencies, and Treasury yields fell as bond prices rose.

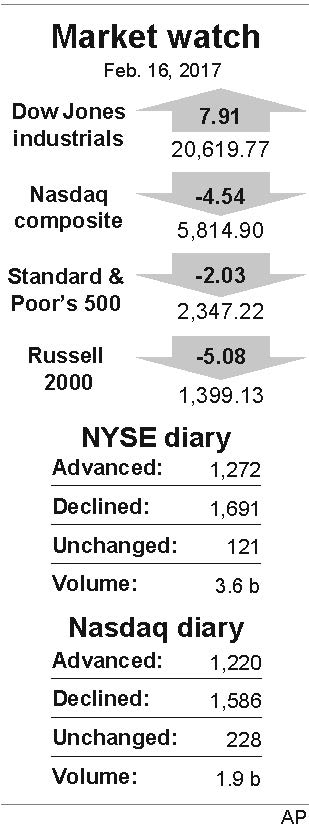

The S&P 500 fell 2.03 points, or 0.1 percent, to 2,347.22. The Dow Jones industrial average rose 7.91 points, less than 0.1 percent, to set another record at 20,619.77. The Nasdaq composite dipped 4.54 points, or 0.1 percent, to 5,814.90. Four stocks fell for every three that rose on the New York Stock Exchange.

The day’s largest loss within the S&P 500 came from TripAdvisor, which fell $5.78, or 11 percent, to $46.92, after reporting weaker revenue and earnings for its latest quarter than analysts forecast.

Avon Products, a direct seller of cosmetics, also plunged after reporting weaker-than-expected results. The company said the number of sales representatives, who are famous for selling its products door to door, slipped from a year earlier. The stock dropped $1.09, or 18.6 percent, to $4.77.

Most companies, though, have been reporting stronger results for the last three months of 2016 than Wall Street forecast.

Treasury yields pulled back, giving back some of their increase from prior days. The 10-year Treasury yield fell to 2.45 percent from 2.50 percent late Wednesday. The two-year Treasury yield fell to 1.21 percent from 1.25 percent, and the 30-year yield fell to 3.05 percent from 3.08 percent.

Yields fell even as more encouraging reports on the economy arrived. Homebuilders broke ground on slightly more projects last month than economists expected, though activity was down from the prior month. A measure of manufacturing in the Philadelphia region suggested that growth is improving, and that figure also beat forecasts.

The reports followed two big ones on Wednesday, which showed that rising optimism among shoppers may be translating into increased spending and that inflation is on the rise. Continued signs of gains in the economy and on inflation could push the Federal Reserve to raise interest rates sooner or more quickly than investors had thought.

Stock markets around the world also slowed Thursday. In Europe, the French CAC 40 fell 0.5 percent, the German DAX index fell 0.3 percent and the U.K. FTSE 100 also slipped 0.3 percent. In Asia, Japan’s Nikkei 225 index fell 0.5 percent, the South Korean Kospi dipped 0.1 percent and the Hang Seng in Hong Kong rose 0.5 percent.

Benchmark U.S. crude rose 25 cents to settle at $53.36 per barrel. Brent crude, the international standard, fell 10 cents to $55.65 a barrel. Natural gas fell 7 cents to $2.85 per 1,000 cubic feet. Heating oil was close to flat at $1.63 per gallon, and wholesale gasoline fell 2 cents to $1.52 per gallon.

Gold rose $8.50 to settle at $1,241.60 per ounce, silver rose 11 cents to $18.07 per ounce and copper fell 2 cents to $2.72 per pound.

The dollar fell to 113.21 yen from 114.26 late Wednesday. The euro rose to $1.0640 from $1.0591, and the British pound rose to $1.2490 from $1.2445.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.