Nasdaq Sets Another Record High on Mixed Day for U.S. Stocks

The Nasdaq composite index notched its fourth record-high close in a row Tuesday, eking out a modest gain on a day when the other major U.S. stock indexes barely budged.

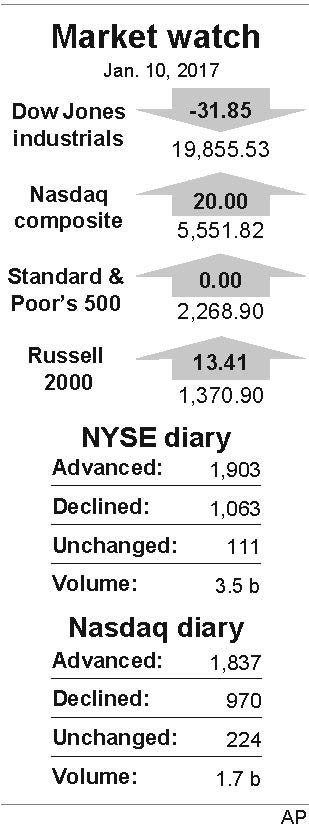

After wavering between small gains and losses for much of the day, the Standard & Poor’s 500 index closed unchanged, while the Dow Jones industrial average posted a slight loss. More stocks rose than fell on the New York Stock Exchange.

Consumer-focused companies, banks and health care stocks were among the biggest gainers. Real estate companies lagged the most. Energy stocks also fell following a drop in crude oil prices.

Encouraging reports on small business confidence and job openings helped keep stocks in the green early in the day. But by midafternoon the indexes began to waver.

“I do think the market stays kind of quiet until it really hits earnings season,” said David Chalupnik, head of equities for Nuveen Asset Management. “The market will really start to take its direction when earnings season starts in full, and that’s Friday.”

The Nasdaq composite increased 20 points, or 0.4 percent, to 5,551.82. The index has closed higher the past six days in a row. The S&P 500 ended unchanged at 2,268.90. The Dow slipped 31.85 points, or 0.2 percent, to 19,855.53.

While the busiest stretch of the next corporate earnings season doesn’t begin until Friday, several companies reported outlooks or preliminary results Tuesday that pleased investors.

Illumina jumped 16.6 percent after it reported better-than-anticipated fourth-quarter sales. The company also launched a new genetic sequencing system called NovaSeq. The stock led the gainers in the S&P 500, adding $23.50 to $165.04.

Alaska Air Group rose 5.2 percent after the airline, which bought Virgin America in December, reported strong monthly results. The stock gained $4.53 to $92.

Zimmer Biomet added 6.2 percent after the medical device maker projected better-than-expected fourth-quarter sales. The stock rose $6.67 to $113.67.

Other companies’ outlooks put traders in a selling mood.

Ascena Retail Group slumped 10 percent after the company slashed its profits forecast, citing end of year sales, which fell for most of its store chains, including Ann Taylor, Lane Bryant and Dress Barn. The stock lost 60 cents to $5.41.

Investors boosted shares in Pacific Continental on news the holding company for Pacific Continental Bank will be bought by Columbia Banking System for $644 million. Pacific Continental shares added $5.35, or 25.7 percent, to $26.15. Columbia shares slid $1.26, or 2.9 percent, to $42.05.

Major stock indexes in Europe notched gains, led by Britain’s FTSE 100, which rose 0.5 percent, closing at a new all-time high for the ninth day in a row. Germany’s DAX added 0.2 percent, while the CAC40 of France inched up 0.1 percent. In Asia, Japan’s Nikkei 225 index dropped 0.8 percent, while the Kospi in South Korea slipped 0.2 percent. Hong Kong’s Hang Seng added 0.8 percent.

U.S. benchmark crude oil lost $1.14, or 2.2 percent, to close at $50.82 a barrel in New York. Brent crude, which is used to price oil sold internationally, fell $1.30, or 2.4 percent, to close at $53.64 a barrel in London. In other energy trading, wholesale gasoline slid 2 cents to $1.55 a gallon and heating oil fell 3 cents to $1.61 a gallon. Natural gas futures rose 18 cents, or 5.6 percent, to $3.28 per 1,000 cubic feet.

Even so, several natural gas companies closed lower. Williams Cos. was down the most among stocks in the S&P 500 index, sliding $3.43, or 10.7 percent, to $28.50. Oneok lost $1.41, or 2.5 percent, to $56.07.

Bond prices fell. The yield on the 10-year Treasury note rose to 2.38 percent from 2.37 percent late Monday.

The pound held steady at $1.2163. The dollar fell to 115.73 yen from 116.06 in late trading Monday. The euro fell to $1.0560 from $1.0577.

In metals trading, the price of gold edged up 60 cents to $1,185.50 an ounce.

Silver added 17 cents, or 1 percent, to $16.85 an ounce. Copper rose 7 cents to $2.61 a pound.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.