Global Markets Steady In Quiet Trading on U.S. Holiday

Global stock markets were steady Thursday as the Thanksgiving holiday in the U.S. kept trading levels subdued.

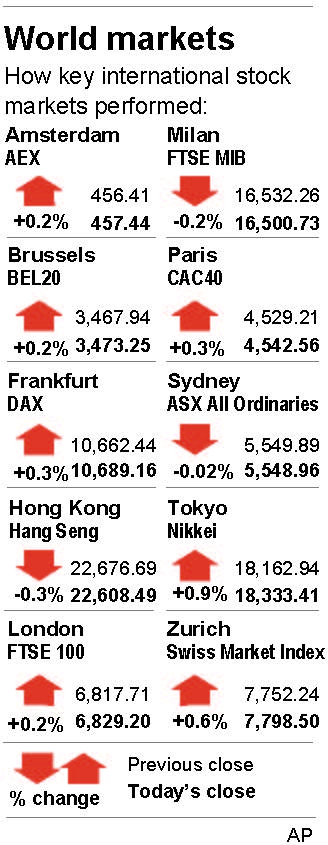

Britain’s FTSE 100 edged up 0.2 percent to 6,829.20 and France’s CAC 40 rose 0.3 percent to 4,542.56. Germany’s DAX also gained 0.3 percent to 10,689.26 after a survey showed businesses in the country remained optimistic in November despite concerns over a slowdown in global commerce and what the impact of Donald Trump’s election in the U.S. might mean for trade.

The Dow Jones industrial average and Standard & Poor’s 500 indexes set records this week in pre-holiday trading. Machinery and equipment makers climbed but technology companies fell. U.S. markets were closed Thursday and will close early on Friday.

“Volumes have been poor … and that’s hardly a surprise given the upcoming Thanksgiving holiday but the juggernaut that is the bull market continues, albeit slowly,” Chris Weston of IG said in a report. He said the Russell 2000 index of small-company stocks, where the real momentum is, gained for the 14th day in a row. Weston said the U.S. Federal Reserve is expected to go ahead with an interest rate hike in December, especially after the release of a slew of strong economic data. Mizuho Bank in Singapore said the strong dollar continued to be the dominant theme, putting most currencies under selling pressure.

Japan’s& Nikkei& rose 0.9 percent to 18,333.41. Sydney’s S&P-ASX 200 and Shanghai Composite Index were flat at 5,485.10 and 3,241.74 respectively. Seoul’s Kospi lost 0.8 percent to 1,971.26 and Hong Kong’s Hang Seng shed 0.3 percent to 22,608.49. Benchmarks in New Zealand and Singapore rose but Taiwan, India and Indonesia retreated.

The dollar rose to 113.34 yen from Wednesday’s 112.60 yen, while the euro strengthened to $1.0555 from $1.0549.

Benchmark U.S. crude rose 1 cent to $47.97 per barrel in electronic trading on the New York Mercantile Exchange. The contract slipped 7 cents on Wednesday. Brent crude, used to price international oils, shed 2 cents to $48.93 in London. The contract lost 17 cents in the previous session.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.