U.S. Stocks Again Rebound as Miners and Machinery Makers Rise

U.S. stocks closed at a record high Monday behind gains for chemical and machinery companies. Energy companies rose as the price of oil continued its recent recovery.

Makers of chemicals and mining companies made the biggest gains, and machinery companies and banks followed. Investors sold government bonds and utility and phone companies. Those stocks climbed earlier in the year as investors sought safety. Stocks have seesawed between small gains and losses for more than a week as investors consider mixed reports on the economy and corporate earnings.

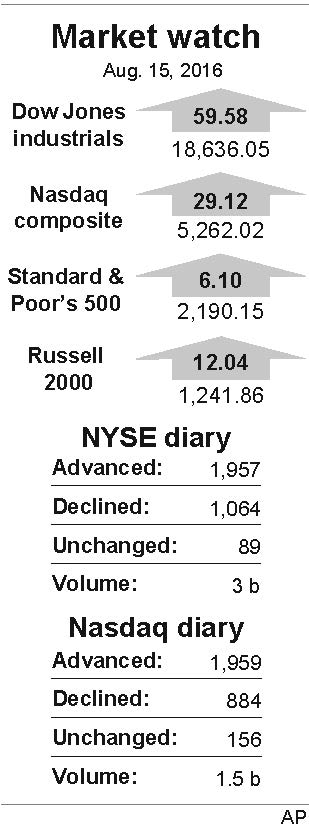

The Dow Jones industrial average climbed 59.58 points or 0.3 percent, to 18,636.05. The S&P’s 500 index rose 6.10 points, or 0.3 percent, to 2,190.15. The Nasdaq composite added 29.12 points, or 0.6 percent, to 5,262.02.

Second-quarter earnings are nearly all in, with this week’s releases from Home Depot, Wal-Mart and Target. Corporate earnings are down once again this quarter and investors don’t expect much growth in the third quarter either, but they are starting to expect improvement after that.

U.S. crude jumped $1.25, or 2.8 percent, to $45.74 a barrel in New York. Brent crude, a benchmark used to price international oils, rose $1.38, or 2.9 percent, to $48.35 a barrel in London. After a steep slide for most of June and July, the price of U.S. crude gained 6.4 percent last week.

Drilling rig operator Transocean added 53 cents, or 5.4 percent, to $10.43. National Oilwell Varco picked up $1.04, or 3.1 percent, to $34.85 and ConocoPhillips rose 81 cents, or 2 percent, to $42.18.

Utility companies took the largest losses, as Southern Co. declined 86 cents, or 1.6 percent, to $51.49 and Consolidated Edison sank $1.88, or 2.4 percent, to $76.24. Phone companies and household goods makers also slipped.

Real estate investment trust Mid-America Apartment Communities will buy competitor Post Properties for about $3.9 billion in stock. Both companies own large numbers of rental properties, and demand for rentals has boomed in recent years because many people are being priced out of the housing market.

The deal values Post Properties at about $72.53 a share based on Friday’s closing prices. The stock rose $5.86, or 9.4 percent, to $68.08 and Mid-America stock lost $5, or 4.9 percent, to $97.15.

In other energy trading, wholesale gasoline rose 3 cents to $1.40 a gallon. Heating oil gained 4 cents to $1.45 a gallon. Natural gas held steady at $2.59 per 1,000 cubic feet.

The price of gold rose $4.30 to $1,347.50 an ounce. Silver advanced 14 cents to $19.85 an ounce. Copper picked up 1 cent to $2.15 a pound.

The dollar fell to 101.25 yen from 101.27 yen and the euro rose to $1.1183 from $1.1164.

Japan’s economy grew at a lower-than-forecast 0.2 percent pace in the April-June quarter, as private demand and exports remained weak. That could push the Bank of Japan to take additional steps to stimulate the national economy. The bank approved a new stimulus package earlier this month, but that wasn’t enough to please investors.

Germany’s DAX was up 0.2 percent and the CAC 40 of France dipped less than 0.1 percent. Britain’s FTSE 100 gained 0.4 percent. Japan’s Nikkei 225 edged 0.3 percent and Hong Kong’s Hang Seng index rose 0.7 percent.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.