Stocks Fall After Biggest Weekly Loss Since 2012

Falling oil prices pushed U.S. stocks down broadly on Monday, extending losses into a second week.

Falling oil prices pushed U.S. stocks down broadly on Monday, extending losses into a second week.

European stocks also fell, and the Russian ruble plunged to a record low against the dollar as the continuing collapse in the price of oil reverberated through global financial markets.

A brief rally after trading opened in the U.S. vanished. Global demand for oil has been waning just as supplies are becoming more abundant.

The stock losses in the U.S. were modest, but markets in Germany and France fell more than 2 percent. The Russian ruble plunged, sending stocks sharply lower there, too.

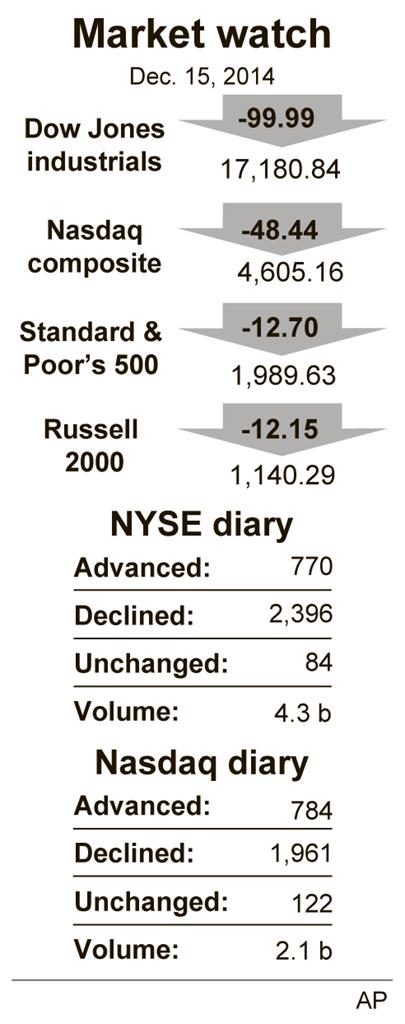

The Standard & Poor’s 500 fell 12.70 points, or 0.6 percent, to 1,989.63. All 10 industry sectors in the index dropped. The losses followed a 3.5 percent drop in the S&P 500 last week, its biggest decline since May 2012.

A solid report on U.S. manufacturers and some merger news helped jolt markets higher after the open, but the gains evaporated after an hour as crude prices fell. The oil slump is worrying investors. Investors also fear it may signal the global economic slowdown is deeper than expected.

The Dow Jones industrial average fell 99.99 points, or 0.6 percent, to 17,180.84. The Nasdaq composite lost 48.44 points, or 1 percent, to 4,605.16.

The ruble sank 13 percent to 65.83 to the dollar. The Russian currency started the year at 32.85 to the dollar. The drop in crude prices has hurt Russia since the country is a major oil exporter and depends heavily on oil for tax revenue.

Several commentators have noted that plunging oil prices could eventually help U.S. stocks because it pushes down gas prices, freeing up money for Americans to spend.

In economic news, U.S. manufacturing output in November surpassed its pre-recession peak as auto production ramped up. The Fed figures are an encouraging sign that America’s factories are somewhat insulated from the global economic slowdown.

Among stocks making big moves:

• Riverbed Technology, a maker of computer-network equipment, jumped $1.57, or 8.4 percent, to $20.31 after agreeing to a $3.6 billion sale to private-equity firm Thoma Bravo and a Canadian pension fund.

• Pet supplies chain PetSmart rose $3.30, or 4.2 percent, to $80.97 after announcing Sunday that it had agreed to an $8.7 billion sale to a group of investors led by BC Partners.

• Range Resources jumped $1.22 or 2.3 percent to $55.40.

Prices for U.S. government bonds fell. The yield on the 10-year Treasury note rose to 2.11 percent from 2.08 percent late Friday.

Benchmark U.S. crude fell $1.90, or 3.3 percent, to close at $55.91 a barrel on the New York Mercantile Exchange. Oil was as high as $107 a barrel in June.

In other energy trading, Brent crude fell 79 cents to close at $61.06 in London. In New York, wholesale gasoline fell 2.1 cents, heating oil fell 1.4 cents, and natural gas fell 7.6 cents.

Precious and industrial metals futures fell. Gold declined $14.80 to $1,207.70 an ounce. Silver fell 49 cents to $16.56 an ounce and copper lost six cents to $2.88 a pound.

This article appeared in print on page 8 of edition of Hamodia.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.