Stocks Decline Amid Interest Rate Worries

The prospect of rising interest rates sent the stock market to its first weekly loss since early August.

The prospect of rising interest rates sent the stock market to its first weekly loss since early August.

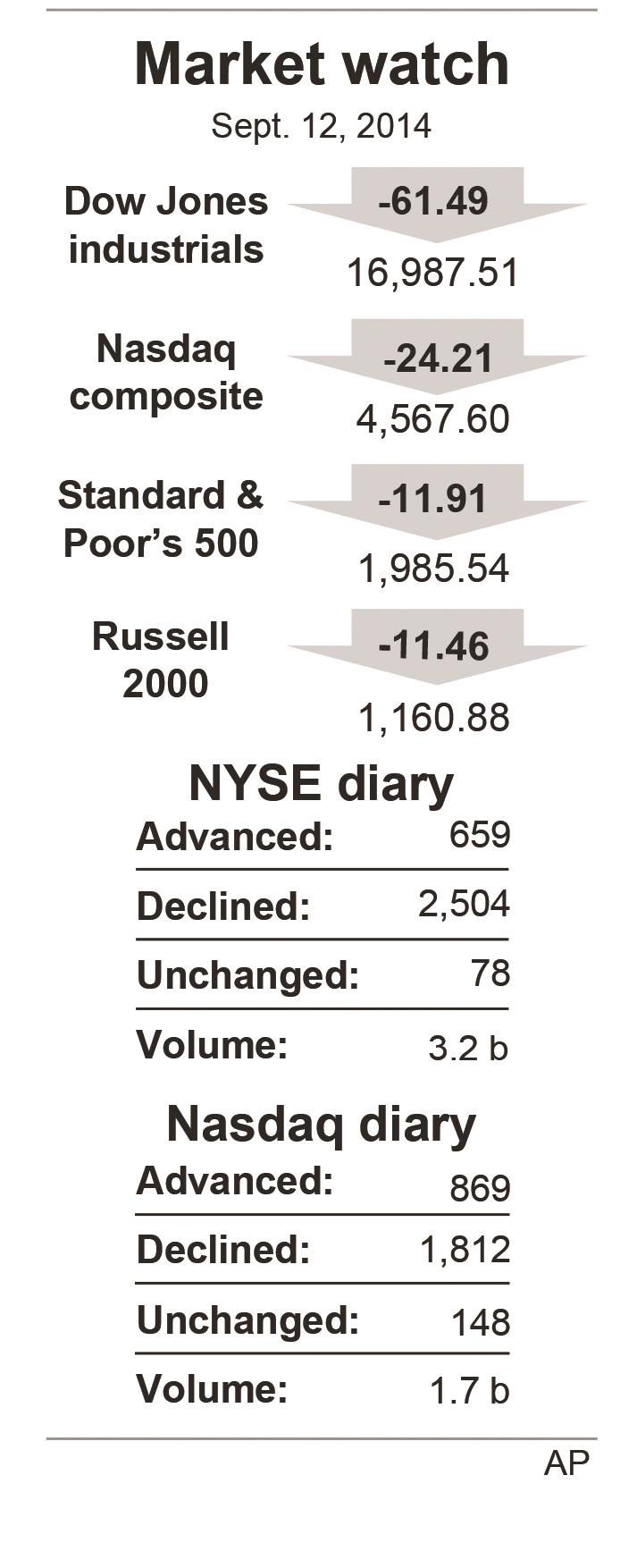

The Standard & Poor’s 500 index fell 11.91 points, or 0.6 percent, to end at 1,985.54 on Friday. The index was down 1.1 percent for the week.

Declines were led by utility companies and other stocks that pay high dividends. Those stocks have been in favor this year as investors hunt for other sources of income because bond yields have been low.

Now that the yield on the ultra-safe 10-year Treasury note has shot to 2.61 percent — its highest level in two months — investors are less willing to hold riskier stocks, even those paying a rich dividend.

The recent rise in bond yields was bolstered Friday by a report showing that U.S. retail sales rose faster last month than economists forecast. That reinforced expectations that the Federal Reserve may start hiking interest rates sooner than expected. The central bank has nearly finished winding down its stimulus program and policy makers start a two-day meeting on Tuesday.

The yield on the 10-year Treasury note has now climbed for seven straight days.

Other stock indexes fell Friday. The Dow Jones industrial average lost 61.49 points, or 0.4 percent, to 16,987.51 The Nasdaq composite dropped 24.21 points, or 0.5 percent, to 4,567.60.

The yield on the 10-year Treasury note has risen from 2.34 percent at the start of the month and is trading at its highest level since early July.

Higher interest rates mean that companies and consumers have to pay more to borrow, leaving them with lower profits and less money to spend.

On Friday, high dividend payers, like utilities and telecoms stocks, sold off. Real estate investment trusts also slumped.

Utility stocks fell 1.8 percent, the biggest drop of the 10 sectors that make up the S&P 500. Energy stocks dropped 1.5 percent and phone company shares slumped 1.2 percent.

The price of oil fell on concerns that global demand is falling while supplies remain ample. Benchmark U.S. crude fell 52 cents to close at $92.27 a barrel on the New York. Brent crude, a benchmark for international oils used by many U.S. refineries, fell 12 cents to close at $97.96 in London. It was Brent’s first close below $98 since April of 2013.

Wholesale gasoline fell 0.5 cent to close at $2.519 a gallon, heating oil fell 1.5 cents to close at $2.741 a gallon and natural gas rose 3.4 cents to close at $3.857 per 1,000 cubic feet.

In metals trading, gold fell $7.50 to $1,231.50 an ounce. Silver rose 1 cent to $18.61 an ounce and copper climbed 1.4 cents to $3.11 a pound.

In currency trading, the dollar remained firm. The euro was 0.2 percent higher at $1.2950 while the dollar rose 0.3 percent to 107.36 against the Japanese yen.

Among Stocks Making Big Moves:

— Conversant, a provider of online advertising services, climbed $8.09, or 30 percent, to $34.80. The rise came after Alliance Data said late Thursday it was buying Conversant for about $2.3 billion.

— Health Care REIT, an investment trust that invests in senior housing and health care real estate. The company said it was selling an additional $1.1 billion of stock to repay debt and fund investments. Its stock dropped $3.24, or 5 percent, to $63.25.

This article appeared in print on page 12 of edition of Hamodia.

To Read The Full Story

Are you already a subscriber?

Click "Sign In" to log in!

Become a Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Become a Print + Web Subscriber

Click “Subscribe” below to begin the process of becoming a new subscriber.

Renew Print + Web Subscription

Click “Renew Subscription” below to begin the process of renewing your subscription.